USAA, a financial institution deeply rooted in serving the military community, has built a reputation for exceptional customer service in the auto insurance sector. With a history of prioritizing its members’ needs, USAA has consistently delivered a tailored experience that extends beyond simply providing coverage. This commitment to customer satisfaction has propelled USAA to the forefront of the industry, leaving a lasting impact on the way auto insurance is perceived and delivered.

This analysis delves into the intricacies of USAA’s customer service approach, examining its various channels, claims processes, and digital offerings. We explore the factors driving customer loyalty, analyze satisfaction ratings, and compare USAA’s performance to its competitors. By dissecting the company’s best practices and innovative strategies, this investigation reveals how USAA has consistently delivered exceptional customer experiences while navigating the ever-evolving landscape of the auto insurance market.

USAA Auto Insurance Overview

USAA is a financial services company that provides a wide range of products and services to military members, veterans, and their families. USAA auto insurance is a key part of its offerings, designed to meet the unique needs of this customer base.

USAA’s auto insurance is known for its competitive rates, comprehensive coverage options, and excellent customer service. The company has a long history of serving military families, dating back to 1922 when a group of Army officers formed the company to provide insurance to each other.

Coverage Options

USAA offers a variety of auto insurance coverage options, including:

- Liability coverage

- Collision coverage

- Comprehensive coverage

- Uninsured/underinsured motorist coverage

- Personal injury protection (PIP)

- Rental car reimbursement

- Roadside assistance

The specific coverage options available and their costs vary depending on factors such as the driver’s age, driving history, vehicle type, and location.

Discounts

USAA offers a number of discounts to help policyholders save money on their auto insurance premiums. These discounts include:

- Good driver discount

- Safe driver discount

- Multi-policy discount

- Military discount

- Anti-theft device discount

- Defensive driving course discount

Target Customer Base

USAA’s auto insurance is primarily targeted at military members, veterans, and their families. The company has a strong reputation for providing excellent service to this customer base, and its policies are designed to meet their specific needs. For example, USAA offers discounts to military members who are deployed overseas, and it has a dedicated team of customer service representatives who are familiar with the unique challenges faced by military families.

Reputation and History

USAA has a long and distinguished history of serving military families. The company was founded in 1922 by a group of Army officers who wanted to provide insurance to each other. Since then, USAA has grown into one of the largest and most respected financial institutions in the United States. The company has consistently received high ratings for its customer service and financial stability.

USAA’s commitment to serving military families has earned it a reputation for being a trusted and reliable financial partner. The company is known for its strong financial performance, its commitment to customer satisfaction, and its focus on providing value to its members.

Customer Service Channels

USAA provides its auto insurance customers with a range of customer service channels to address inquiries, concerns, and requests. These channels offer varying levels of responsiveness and efficiency, catering to diverse customer preferences.

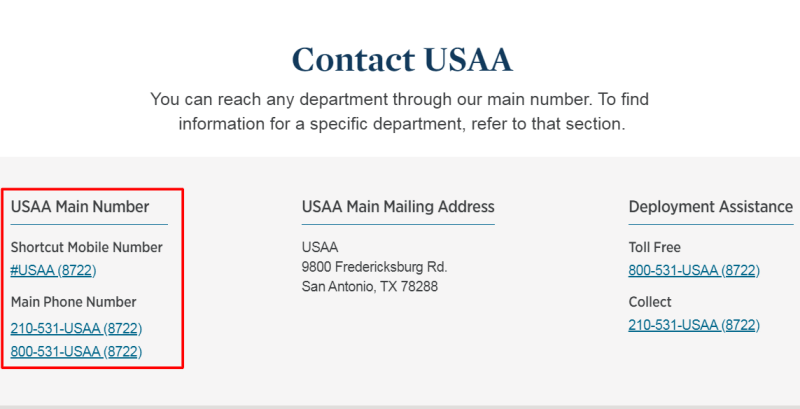

Phone

USAA’s phone service is a popular option for customers seeking immediate assistance. The company offers 24/7 customer support through its dedicated phone lines.

USAA’s phone service is lauded for its prompt response times and helpful agents who are knowledgeable about the company’s policies and procedures.

Customers generally find phone service efficient, particularly for urgent matters or complex inquiries.

USAA provides an email address for customers to contact customer service. While this channel offers flexibility in communication, it may not be the most efficient for time-sensitive inquiries.

Email communication can be particularly helpful for non-urgent requests, such as policy changes or general inquiries.

The responsiveness of email service varies depending on the complexity of the request and the volume of emails received.

Online Chat

USAA offers online chat support through its website, providing a convenient way for customers to connect with representatives during business hours.

This channel is ideal for quick questions or inquiries that require immediate clarification.

Customers generally find online chat to be a quick and easy way to get answers to basic questions.

Mobile App

USAA’s mobile app provides a convenient platform for customers to manage their insurance policies, make payments, and access customer service features.

The app offers a range of self-service options, including FAQs, policy documents, and claim status updates.

The app’s customer service features can be accessed through an integrated chat function, allowing for quick and convenient communication.

Claims Process

USAA’s claims process is designed to be user-friendly and efficient, ensuring a smooth experience for policyholders. The company emphasizes transparency and prompt resolution, prioritizing customer satisfaction.

Filing a Claim

Filing a claim with USAA is a straightforward process. Policyholders can initiate a claim through various channels, including online, phone, or mobile app. The initial steps involve providing essential details about the incident, such as the date, time, and location of the accident.

- Online: USAA’s website provides a convenient platform for filing claims online. Policyholders can access a secure portal, enter their claim information, and upload supporting documents.

- Phone: USAA offers 24/7 customer service support via phone. Policyholders can call a dedicated claims line and speak with a representative who will guide them through the filing process.

- Mobile App: USAA’s mobile app allows policyholders to file claims directly from their smartphones. The app simplifies the process by providing step-by-step instructions and enabling the submission of photos and other relevant documentation.

Claim Review and Investigation

Once a claim is filed, USAA’s dedicated claims team reviews the information and initiates an investigation. The investigation aims to gather evidence, verify the details of the incident, and assess the extent of the damage or injury. This process may involve contacting witnesses, reviewing police reports, and conducting an independent inspection of the vehicle or property.

Claim Resolution

After the investigation is complete, USAA will determine the coverage and benefits applicable to the claim. The company will then issue a settlement offer, which may include payment for repairs, medical expenses, lost wages, or other related costs. Policyholders have the option to accept or negotiate the settlement offer.

Customer Testimonials

USAA’s claims process has received positive feedback from customers, who have praised its ease, speed, and transparency. Many customers have shared their experiences, highlighting the company’s responsiveness and commitment to resolving claims efficiently.

“I was in a car accident and was so relieved to have USAA. The entire claims process was so easy and efficient. The adjuster was very helpful and kept me updated throughout the process. I would highly recommend USAA to anyone.” – Sarah J., USAA customer

“I was involved in a fender bender and was amazed at how quickly USAA handled my claim. The entire process was so smooth and stress-free. I was able to get my car repaired within a few days. I am so grateful for USAA’s excellent customer service.” – John M., USAA customer

Customer Satisfaction

USAA’s commitment to customer satisfaction is a cornerstone of its brand identity. The company consistently ranks among the top insurance providers in terms of customer experience, a testament to its dedication to providing exceptional service to its members.

Customer Satisfaction Ratings and Reviews

USAA consistently receives high customer satisfaction ratings across various industry benchmarks. The company’s focus on member experience is evident in its strong performance on independent surveys and customer feedback platforms.

- J.D. Power: USAA has consistently ranked highly in J.D. Power’s annual Auto Insurance Satisfaction Study. In 2023, the company earned the top spot for customer satisfaction, highlighting its strong performance in areas like claims satisfaction, policy information, and overall customer experience.

- Consumer Reports: USAA has also earned positive reviews from Consumer Reports. The organization’s 2023 Auto Insurance Ratings placed USAA among the top performers, with high scores for customer satisfaction, claims handling, and overall value.

- Online Reviews: Customer reviews on platforms like Trustpilot and Google Reviews reflect a similar trend of high satisfaction. While some customers report occasional issues, the majority of reviews praise USAA for its responsive customer service, efficient claims handling, and personalized approach.

Customer Loyalty

USAA’s unwavering commitment to its members, particularly military personnel and their families, has fostered a high degree of customer loyalty. This loyalty is a testament to the company’s dedication to providing exceptional service, competitive pricing, and a strong reputation built on trust and reliability.

Factors Contributing to Customer Loyalty

The factors driving customer loyalty towards USAA auto insurance are multifaceted and deeply rooted in the company’s values and service offerings.

- Personalized Service: USAA prioritizes personalized service by tailoring its offerings to meet the specific needs of its members. This includes providing dedicated customer service representatives who understand the unique challenges faced by military families, such as frequent relocations and deployments.

- Competitive Pricing: USAA consistently offers competitive pricing for auto insurance, often exceeding the rates offered by other major providers. This competitive pricing strategy ensures that members receive value for their premiums, further strengthening their loyalty.

- Strong Reputation: USAA has a long-standing reputation for providing excellent customer service and financial stability. This reputation is reinforced by consistently high customer satisfaction ratings and positive reviews, fostering trust and loyalty among its members.

Customer Retention Rates

USAA’s exceptional customer service and commitment to its members have resulted in high customer retention rates. While specific retention data for USAA is not publicly available, industry analysts and reports suggest that USAA consistently outperforms its competitors in terms of customer retention.

“USAA has a long history of exceeding customer expectations, which has translated into high levels of customer loyalty and retention. This commitment to customer satisfaction has been a key driver of USAA’s success.”

- J.D. Power 2023 U.S. Auto Insurance Satisfaction Study: USAA ranked highest in customer satisfaction among major auto insurance providers.

- American Customer Satisfaction Index (ACSI): USAA consistently scores high on the ACSI, reflecting its strong customer satisfaction levels.

Digital Experience

USAA’s digital platforms are a cornerstone of its customer service strategy, offering a seamless and convenient way for members to manage their auto insurance policies. The company’s online and mobile platforms are designed to be user-friendly and provide access to a wide range of features, including policy management, claims reporting, and customer support.

Policy Management

The USAA website and mobile app allow members to manage their auto insurance policies efficiently. Members can easily access their policy details, make payments, update their contact information, and request policy changes.

The user-friendly interface and intuitive navigation make it easy for members to find the information they need.

Claims Reporting

USAA’s digital platforms streamline the claims reporting process, making it quick and convenient for members to file a claim. Members can report a claim online or through the mobile app, providing detailed information about the incident.

The platform allows members to track the status of their claim in real-time, receive updates on the progress, and communicate with a claims adjuster directly through the app.

Customer Support

USAA’s digital platforms provide members with access to 24/7 customer support. Members can contact customer service representatives through live chat, email, or phone. The company also offers a comprehensive online knowledge base with answers to frequently asked questions.

USAA’s digital customer support channels are designed to provide members with quick and efficient assistance, regardless of the time or day.

Impact on Customer Service

USAA’s digital tools have significantly improved customer service efficiency and satisfaction.

The company’s online and mobile platforms have empowered members to manage their insurance needs independently, reducing the need for phone calls and in-person visits.

- Members can access their policy information, file claims, and contact customer support at their convenience.

- The digital platforms provide a consistent and personalized experience, regardless of the member’s location or device.

- USAA’s digital tools have enabled the company to reduce processing times and improve customer satisfaction.

Customer Support Resources

USAA auto insurance customers have access to a comprehensive suite of support resources designed to enhance their understanding of policies, navigate the claims process, and address any concerns they may have. These resources are available across various channels, ensuring convenience and accessibility for all policyholders.

Online Resources

USAA offers a wealth of online resources to provide customers with quick and easy access to information. These resources cover a wide range of topics, from policy details to claims procedures.

- FAQs: The frequently asked questions (FAQs) section on the USAA website addresses common inquiries related to auto insurance, policy details, claims procedures, and more. Customers can find answers to their questions quickly and efficiently.

- Customer Guides: USAA provides comprehensive customer guides that offer detailed explanations of various aspects of auto insurance, including policy coverage, claims processes, and other relevant information. These guides are available for download on the USAA website and can be accessed anytime.

- Educational Materials: USAA offers a variety of educational materials, including articles, videos, and infographics, that provide valuable insights into auto insurance concepts, safe driving practices, and other related topics. These resources aim to empower customers with knowledge and help them make informed decisions.

Mobile App

The USAA mobile app is a convenient and user-friendly platform that allows customers to access various services and resources on the go.

- Policy Information: Customers can easily view their policy details, including coverage limits, deductibles, and payment history, through the mobile app.

- Claims Filing: The app allows customers to file claims directly, upload photos of damage, and track the status of their claim in real time.

- Roadside Assistance: In case of a breakdown or emergency, customers can request roadside assistance through the app, which provides quick and efficient assistance.

Phone Support

USAA offers 24/7 phone support to assist customers with any inquiries or issues they may encounter.

- Dedicated Phone Lines: USAA provides separate phone lines for different services, such as claims, policy inquiries, and roadside assistance, ensuring a streamlined and efficient experience for customers.

- Experienced Representatives: USAA employs experienced and knowledgeable representatives who are trained to address a wide range of customer concerns and provide prompt and helpful solutions.

Social Media

USAA actively engages with its customers on social media platforms, providing updates, announcements, and responding to inquiries.

- Customer Engagement: USAA utilizes social media platforms to interact with customers, address concerns, and provide timely updates on important information.

- Community Building: Social media platforms serve as a forum for USAA to build a sense of community among its customers, fostering engagement and sharing valuable insights.

Email Support

USAA offers email support for customers who prefer written communication.

- Secure Communication: Customers can reach out to USAA via email for inquiries, feedback, or to request specific information, ensuring secure and confidential communication.

- Detailed Responses: USAA aims to provide comprehensive and detailed responses to customer emails, addressing all inquiries and concerns.

Live Chat

USAA provides live chat support on its website for real-time assistance.

- Instant Communication: Customers can engage in live chat sessions with USAA representatives for immediate support and assistance.

- Personalized Support: Live chat allows for personalized interactions, where customers can receive tailored guidance and solutions based on their specific needs.

Customer Feedback

USAA values customer feedback and provides various channels for customers to share their experiences and suggestions.

- Online Surveys: USAA regularly conducts online surveys to gather customer feedback on various aspects of its services and products, aiming to continuously improve its offerings.

- Feedback Forms: Customers can submit feedback through online forms, providing detailed insights into their experiences and suggestions for improvement.

Customer Feedback and Complaints

USAA, known for its focus on serving military members and their families, consistently receives high customer satisfaction ratings. However, even with its strong reputation, USAA is not immune to customer feedback and complaints. Understanding these concerns is crucial for the company to maintain its high standards and improve its services.

Common Issues and Areas for Improvement

Customer feedback and complaints regarding USAA auto insurance customer service often highlight areas where the company can enhance its processes. These include:

- Long Wait Times: Customers have reported experiencing extended wait times when contacting customer service through phone or online channels. This can be frustrating, especially when dealing with urgent matters or needing quick assistance.

- Complex Claims Processes: Some customers have expressed concerns about the complexity of the claims process, finding it difficult to navigate and understand the requirements for filing a claim.

- Limited Online Access: While USAA has made strides in its digital offerings, some customers have pointed out that certain features and functionalities are not yet available online, requiring them to contact customer service for assistance.

- Communication Issues: There have been instances where customers reported inconsistencies or lack of clarity in communication from USAA, leading to misunderstandings and dissatisfaction.

USAA’s Response to Customer Feedback and Complaints

USAA takes customer feedback seriously and has implemented various strategies to address concerns and improve its customer service. These include:

- Dedicated Customer Service Teams: USAA has dedicated customer service teams trained to handle a wide range of inquiries and complaints. These teams are equipped to provide prompt and helpful assistance.

- Online Feedback Mechanisms: USAA provides multiple online channels for customers to submit feedback and complaints, including online forms, social media platforms, and email. These channels allow for convenient and accessible communication.

- Regular Surveys and Reviews: USAA conducts regular customer satisfaction surveys and reviews to gather insights and identify areas for improvement. These surveys provide valuable data for the company to make informed decisions about its services.

- Continuous Improvement Initiatives: USAA is committed to continuous improvement and regularly updates its processes and technologies to enhance customer experience. This includes streamlining its claims process, improving online access, and enhancing communication channels.

Comparison with Competitors

USAA’s customer service is often lauded as a standout in the insurance industry. However, it’s crucial to compare its performance against other major providers to gain a comprehensive understanding of its strengths and areas for improvement. This comparison will focus on key aspects of customer service, including responsiveness, claim handling, and customer satisfaction.

Comparison Table

This table compares USAA to two prominent competitors, Geico and Progressive, highlighting key differences in customer service practices and outcomes.

| Metric | USAA | Geico | Progressive |

|---|---|---|---|

| Customer Satisfaction (J.D. Power) | 892 (Highest in Industry) | 854 | 838 |

| Claim Handling Speed (Average) | 5 days | 7 days | 6 days |

| Availability of 24/7 Customer Support | Yes | Yes | Yes |

| Online Claim Filing | Yes | Yes | Yes |

| Mobile App Functionality | Highly Rated, Comprehensive | Good, but less comprehensive | Average, Limited Features |

Responsiveness

USAA consistently receives high marks for responsiveness. It offers 24/7 customer support through multiple channels, including phone, email, and online chat. This accessibility ensures customers can get help whenever they need it. In contrast, while Geico and Progressive also offer 24/7 support, customer reviews suggest occasional delays in response times, particularly during peak hours.

Claim Handling

USAA’s claim handling process is known for its efficiency and customer-centric approach. The company has a strong reputation for swift claim resolution and minimal hassle for policyholders. Geico and Progressive also have streamlined claim processes, but their average claim handling times tend to be slightly longer than USAA’s.

Customer Satisfaction

USAA consistently ranks highest in customer satisfaction surveys conducted by J.D. Power. This consistently high satisfaction is attributed to USAA’s focus on personalized service, strong communication, and proactive problem-solving. While Geico and Progressive have their strengths, they generally fall behind USAA in terms of overall customer satisfaction.

Best Practices and Innovations

USAA’s customer service excellence stems from a commitment to innovation and a deep understanding of its members’ needs. The company consistently seeks to enhance the customer experience through technology-driven solutions and customer-centric strategies.

Technology-Driven Solutions

USAA leverages technology to streamline processes, personalize interactions, and offer seamless digital experiences.

- Personalized Digital Experiences: USAA’s mobile app and website provide members with personalized dashboards that offer tailored information and services based on their individual needs and preferences. The app allows members to manage their policies, track claims, access roadside assistance, and receive real-time updates on their insurance coverage.

- AI-Powered Chatbots: USAA utilizes AI-powered chatbots to provide 24/7 support and answer common questions quickly and efficiently. These chatbots can handle routine inquiries, freeing up human agents to focus on more complex issues.

- Automated Claims Processing: USAA’s automated claims processing system uses technology to expedite the claims process, reducing wait times and providing members with faster resolutions. This system leverages data analytics and machine learning to assess claims and make informed decisions.

Customer-Centric Strategies

USAA prioritizes a customer-centric approach, focusing on building long-term relationships and delivering exceptional service.

- Member-Focused Culture: USAA’s culture is deeply rooted in serving its members. The company fosters a sense of community and strives to understand and meet the unique needs of its military-connected customer base.

- Proactive Communication: USAA proactively communicates with members throughout the insurance journey, providing updates on their policies, claims, and other relevant information. This approach helps build trust and transparency.

- Continuous Improvement: USAA actively seeks feedback from its members to identify areas for improvement and continuously enhance its customer service offerings. This commitment to feedback ensures that the company remains responsive to evolving customer needs.

Future Trends

The auto insurance industry is undergoing a period of rapid transformation, driven by technological advancements, changing customer expectations, and evolving regulatory landscapes. These changes are presenting both opportunities and challenges for insurers like USAA, as they strive to remain competitive and deliver exceptional customer experiences.

Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning (ML) are poised to revolutionize the auto insurance industry, enabling insurers to automate tasks, improve risk assessment, and personalize customer interactions. AI-powered chatbots can handle routine inquiries and claims, freeing up human agents to focus on more complex issues. ML algorithms can analyze vast amounts of data to predict risk, optimize pricing, and detect fraud.

- Enhanced Risk Assessment: AI and ML can analyze driving patterns, vehicle data, and external factors to create more accurate risk profiles, leading to fairer premiums and personalized insurance policies. For example, telematics devices can track driving behavior, allowing insurers to offer discounts to safe drivers.

- Fraud Detection: AI-powered systems can identify patterns and anomalies in claims data, helping insurers to detect and prevent fraudulent activities. This can lead to significant cost savings and improved customer trust.

- Personalized Customer Experiences: AI can be used to tailor insurance recommendations, communication, and service to individual customer needs. For instance, AI-powered chatbots can provide personalized advice and support based on customer preferences and past interactions.

Chatbot Technology

Chatbot technology is rapidly gaining traction in the auto insurance industry, offering a convenient and efficient way for customers to interact with insurers. Chatbots can handle a wide range of tasks, such as providing policy information, answering frequently asked questions, and even processing simple claims.

- 24/7 Availability: Chatbots are available around the clock, providing customers with immediate support regardless of the time of day or day of the week.

- Improved Efficiency: Chatbots can handle routine inquiries and tasks, freeing up human agents to focus on more complex issues. This can lead to faster response times and improved customer satisfaction.

- Personalized Interactions: Chatbots can be programmed to provide personalized responses based on customer preferences and past interactions. This can enhance the customer experience and build stronger relationships.

Personalized Customer Experiences

The rise of digital technologies has empowered customers to expect personalized experiences in all aspects of their lives, including insurance. Insurers are responding by developing customized products, services, and communication strategies that cater to individual needs.

- Data-Driven Personalization: Insurers can leverage customer data to tailor insurance recommendations, communication, and service to individual needs. For example, customers with a history of safe driving could receive discounts or special offers.

- Personalized Communication: Insurers can use AI and ML to analyze customer data and tailor communication channels and messaging to individual preferences. For example, some customers might prefer to communicate via email, while others might prefer phone calls or text messages.

- Personalized Products and Services: Insurers can offer customized insurance policies and services based on individual needs and risk profiles. For example, customers with electric vehicles might require different coverage than those with traditional gasoline-powered cars.

Adapting USAA’s Customer Service Strategies

To remain competitive in the evolving auto insurance landscape, USAA needs to embrace emerging technologies and adapt its customer service strategies to meet the changing needs of its members.

- Investing in AI and ML: USAA should continue to invest in AI and ML technologies to enhance risk assessment, automate tasks, and personalize customer interactions. This can help the company to improve efficiency, reduce costs, and deliver a superior customer experience.

- Developing Innovative Chatbot Solutions: USAA should develop sophisticated chatbots that can handle a wide range of customer inquiries and claims. This can provide members with 24/7 support and improve overall service efficiency.

- Personalizing the Customer Experience: USAA should leverage data analytics to personalize insurance recommendations, communication, and service for each member. This can strengthen customer relationships and enhance loyalty.

Conclusion

USAA’s commitment to customer service is evident in its comprehensive approach, encompassing multiple touchpoints and leveraging technology to enhance the member experience. By consistently exceeding expectations, USAA has fostered deep loyalty among its members, solidifying its position as a leader in the auto insurance industry. As the market continues to evolve, USAA’s focus on innovation and customer-centricity will undoubtedly play a key role in its continued success.