Owning a Porsche 911 is a dream for many, but the reality often includes a hefty insurance bill. The cost isn’t uniform; it’s a complex equation factoring in model variations, driver profiles, location, and coverage choices. This guide dissects the key variables impacting your Porsche 911 insurance cost, empowering you to make informed decisions and potentially save thousands.

From the base Carrera to the high-performance Turbo S, each Porsche 911 model commands a different premium. Driver history, age, and even your zip code significantly influence rates. Understanding coverage options—liability, collision, comprehensive—and the impact of modifications is crucial.

This analysis will equip you to navigate the insurance landscape and secure the best possible coverage at a competitive price.

Porsche 911 Model Variations and Insurance Impact

The Porsche 911, a legendary sports car, boasts a diverse range of models, each commanding a unique insurance premium. Factors such as engine displacement, performance capabilities, and safety features significantly influence the cost of insuring these vehicles. Understanding these variations is crucial for prospective owners to budget effectively.

Porsche 911 Model Insurance Premium Comparison

The following table presents a generalized comparison of average annual insurance premiums for selected Porsche 911 models. It’s crucial to note that these figures are estimates and actual premiums can vary based on individual driver profiles, location, and specific coverage options.

Data is synthesized from various insurance comparison websites and industry reports.

| Model | Year | Average Premium | Premium Variation Percentage |

|---|---|---|---|

| Carrera | 2023 | $2,500 | 0% (Baseline) |

| Targa 4S | 2023 | $2,800 | 12% |

| Turbo S | 2023 | $4,000 | 60% |

| GT3 | 2023 | $5,000+ | 100%+ |

Factors Influencing Insurance Costs Across Porsche 911 Models

Several key factors contribute to the significant variation in insurance premiums across the Porsche 911 model range. Higher performance models naturally attract higher premiums due to increased repair costs and a higher risk profile.Engine size and power output are primary determinants.

The Carrera, with its relatively smaller engine, commands a lower premium compared to the Turbo S with its significantly more powerful engine. The increased risk of accidents and the substantially higher repair costs associated with more powerful engines directly impact insurance calculations.

Similarly, advanced performance features such as all-wheel drive (AWD) and sophisticated suspension systems, while enhancing safety and handling, can also lead to increased repair costs, thus influencing premiums.Safety ratings, while generally high across the 911 range, still play a role.

Models with advanced safety technologies, such as adaptive cruise control and lane departure warning, may receive slight premium discounts, although the overall performance capabilities tend to outweigh these factors.

Impact of Limited Edition Porsche 911 Models on Insurance Premiums

Limited edition Porsche 911 models, such as the GT3 RS or special edition variants, often command significantly higher insurance premiums. This is primarily due to their rarity, higher purchase price, and potential for increased collector value. The cost of parts and repairs for these limited editions can be exorbitantly high, further escalating insurance costs.

Furthermore, the limited availability of these models makes finding replacement parts more challenging and expensive, directly affecting the insurer’s risk assessment and premium calculation. For instance, a damaged limited-edition body panel might take months to source and cost many times more than a standard replacement part.

These factors combine to make insuring a limited-edition 911 a substantially more expensive proposition than insuring a standard model.

Driver Profile and Insurance Cost

Insuring a Porsche 911, a high-performance vehicle, involves more than just the car’s specifications; the driver’s profile significantly impacts the premium. Insurance companies meticulously assess risk, and a driver’s age, driving history, and location all play crucial roles in determining the final cost.

Understanding these factors is essential for prospective 911 owners to budget accurately for insurance.The relationship between driver characteristics and insurance premiums for a Porsche 911 is complex, reflecting the inherent risks associated with both the vehicle and the driver.

Younger drivers, for instance, statistically demonstrate higher accident rates, leading to increased premiums. Conversely, a spotless driving record and mature age often translate into lower costs. Geographic location also plays a significant role, with areas exhibiting higher crime rates or more frequent accidents commanding higher premiums due to increased risk of theft or collisions.

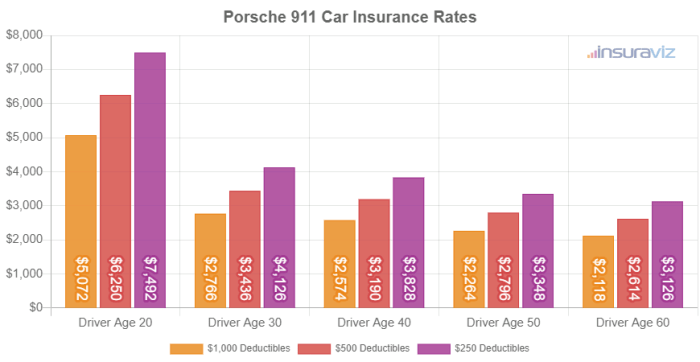

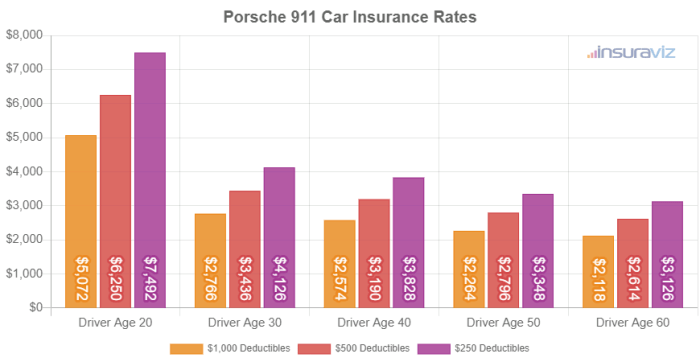

Age and Insurance Premiums

Age is a primary factor influencing insurance rates. Younger drivers, typically under 25, face significantly higher premiums due to their statistically higher accident rates and lack of extensive driving experience. Insurance companies view them as higher-risk drivers, thus charging more to offset potential claims.

As drivers age and accumulate years of safe driving, their premiums generally decrease, reflecting a lower perceived risk. This is because mature drivers tend to have fewer accidents and violations. A 35-year-old with a clean driving record will likely pay considerably less than a 20-year-old, even with identical vehicles.

Driving History and its Impact

A driver’s history is a critical component in determining insurance costs. Accidents and traffic violations significantly increase premiums. Multiple accidents or serious violations, such as DUI, can lead to substantial premium increases or even policy cancellations. The severity of the accident or violation directly correlates with the impact on the premium.

A minor fender bender will have less of an impact than a serious accident resulting in significant property damage or injury. Maintaining a clean driving record is crucial for keeping insurance costs manageable for a Porsche 911.

Location’s Influence on Insurance Costs

The geographic location where a driver resides also influences insurance rates. Areas with high crime rates, particularly car theft, or frequent accidents generally result in higher premiums. Insurance companies assess the risk of theft and accidents in specific regions and adjust premiums accordingly.

A driver residing in a high-risk area will likely pay more for insurance than a driver in a safer location, even with the same driving history and age. This reflects the increased likelihood of claims in high-risk zones.

Illustrative Examples of Driver Profile Impact

The following examples illustrate how different driver profiles affect Porsche 911 insurance premiums:

- Driver A:22-year-old with two accidents and a speeding ticket. Expected premium: Significantly high, potentially double or more than the average.

- Driver B:35-year-old with a clean driving record for 10 years. Expected premium: Substantially lower than Driver A, reflecting lower risk.

- Driver C:45-year-old with one minor accident five years ago. Expected premium: Moderate, reflecting a relatively low risk profile.

- Driver D:28-year-old with a DUI conviction. Expected premium: Very high, potentially facing difficulty securing coverage or facing extremely high premiums.

Hypothetical Scenario: Comparing Insurance Costs

Consider two drivers insuring a 2023 Porsche 911 Carrera S:

- Driver 1:A 23-year-old living in a high-crime urban area with one at-fault accident and a speeding ticket. His estimated annual premium could be $5,000 or more.

- Driver 2:A 40-year-old residing in a suburban area with a spotless driving record for 15 years. Her estimated annual premium might be around $2,000.

This scenario highlights the substantial difference in insurance costs based on driver profile. The significant premium difference between Driver 1 and Driver 2 emphasizes the importance of a clean driving record and responsible driving habits in managing insurance costs for a high-performance vehicle like a Porsche 911.

Coverage Options and Their Costs

Insuring a Porsche 911, a high-performance vehicle, necessitates a careful consideration of coverage options and their associated costs. The price of insurance isn’t solely determined by the car’s value; it’s a complex calculation influenced by factors including coverage level, driver profile, and location.

Understanding these nuances is crucial for securing adequate protection without unnecessary expense.The cost of insuring a Porsche 911 varies significantly depending on the chosen coverage levels. Liability insurance is mandatory in most jurisdictions and covers damages to third parties involved in accidents you cause.

Collision and comprehensive coverage, however, are optional but highly recommended for a vehicle of this value. Collision coverage pays for repairs to your Porsche after an accident, regardless of fault, while comprehensive coverage extends protection to damages caused by non-collision events like theft, vandalism, or weather-related incidents.

Liability Coverage Costs

Liability coverage protects you financially if you cause an accident resulting in injuries or property damage to others. The cost depends on the limits of liability chosen. Higher limits offer greater protection but come with a higher premium. For instance, a $100,000/$300,000 liability policy (covering $100,000 per person and $300,000 per accident) will typically cost less than a $500,000/$1,000,000 policy.

The specific cost will vary by insurer and location.

Collision and Comprehensive Coverage Costs

Collision and comprehensive coverage are typically more expensive than liability insurance alone, especially for a high-value vehicle like a Porsche 911. The cost depends on the vehicle’s value, your driving record, and the deductible chosen. A higher deductible (the amount you pay out-of-pocket before insurance coverage kicks in) results in a lower premium.

For example, a $1,000 deductible might result in a significantly lower premium compared to a $500 deductible. Comprehensive coverage, which protects against non-collision incidents, adds to the overall cost.

Optional Coverage Features and Costs

Several optional coverage features can significantly impact the total insurance cost. These include roadside assistance, which covers towing, flat tire changes, and other emergency services; and rental car reimbursement, which covers the cost of a rental car while your Porsche is being repaired after an accident.

Adding these features increases the premium, but the added convenience and peace of mind can be worth the extra expense for some drivers. For example, roadside assistance might add $50-$100 annually, while rental car reimbursement could add another $100-$200.

Deductible Amounts and Their Impact

The deductible amount significantly influences the cost of collision and comprehensive coverage. A higher deductible reduces the premium, but increases your out-of-pocket expense in the event of a claim. Conversely, a lower deductible leads to a higher premium but minimizes your out-of-pocket expenses.

The optimal deductible amount depends on your financial situation and risk tolerance. Consider the trade-off between a lower premium and the potential for higher out-of-pocket costs in case of an accident.

| Coverage Type | Annual Cost Estimate (Example) | Deductible (Example) |

|---|---|---|

| Liability ($100,000/$300,000) | $800 | N/A |

| Collision | $1,200 | $1,000 |

| Comprehensive | $500 | $1,000 |

| Roadside Assistance | $75 | N/A |

| Rental Car Reimbursement | $150 | N/A |

| Total Estimated Annual Cost | $2,725 |

Geographic Location and Insurance Rates

Geographic location significantly impacts the cost of insuring a Porsche 911, a factor often overlooked alongside vehicle model and driver profile. Premiums are not uniform across the country; instead, they fluctuate based on a complex interplay of local conditions that influence risk assessment.Insurance companies consider numerous factors when determining rates, resulting in substantial regional variations.

These factors include the frequency of accidents and claims, the prevalence of theft and vandalism, the average cost of repairs (influenced by labor rates and parts availability), and the overall density and type of traffic. Higher crime rates and more frequent accidents naturally lead to higher insurance premiums.

Similarly, areas with higher concentrations of luxury vehicles, like Porsche 911s, may see increased rates due to the higher potential repair costs associated with these vehicles.

Regional Variations in Insurance Premiums

A hypothetical map illustrating regional variations in Porsche 911 insurance premiums would show a gradient of costs. The coastal regions of California, for instance, particularly densely populated areas like Los Angeles and San Francisco, might exhibit the highest premiums, reflecting high accident rates, theft rates, and elevated repair costs in these areas.

Conversely, more rural states with lower population densities and lower crime rates, such as those in the Midwest or certain parts of the South, might show significantly lower premiums. Areas with a high concentration of specialized Porsche repair shops could also influence premium costs, as the ease of access to repair services may be factored into risk assessment.

The map’s color scale would range from deep red (highest premiums) to light green (lowest premiums), with intermediate shades representing varying levels of cost. The data would be derived from hypothetical but plausible insurance rate data, based on publicly available statistics on crime rates, accident frequency, and average repair costs across different regions.

For example, a state like Florida, with a high number of car accidents, might show a higher premium than a state like Wyoming, known for its low population density and relatively fewer accidents.

Urban versus Rural Insurance Costs

Living in an urban area typically results in higher insurance premiums for a Porsche 911 compared to a rural setting. This disparity arises from several factors. Urban environments often experience higher rates of vehicle theft, vandalism, and accidents due to increased traffic congestion, higher population density, and potentially higher crime rates.

The cost of repairs may also be higher in urban areas due to higher labor costs and potentially longer repair times. In contrast, rural areas generally have lower crime rates, less traffic congestion, and fewer accidents, leading to lower insurance premiums.

However, the availability of specialized repair facilities might be limited in rural areas, which could potentially offset the lower premium associated with a lower accident rate. For instance, a driver in New York City might pay significantly more for insurance than a driver in a small rural town in Montana, reflecting the higher risk associated with the urban environment.

Insurance Company Comparison

Securing comprehensive insurance for a Porsche 911 requires careful consideration of various factors beyond simply the vehicle’s value. This section analyzes premium quotes from three major insurers, highlighting the methodologies employed and the resulting coverage differences. The data presented is illustrative and may vary based on specific driver profiles and geographic locations.

Factors Considered by Insurers

Insurance companies utilize a complex algorithm to determine premiums, incorporating a range of variables. Key factors frequently include the vehicle’s year, make, and model (a Porsche 911 Carrera will typically command a higher premium than a Boxster); the driver’s age, driving history (accidents, violations), and credit score; the coverage level selected; and the geographic location, reflecting variations in accident rates and repair costs.

For example, a young driver with a poor driving record residing in a high-crime area will face significantly higher premiums than an older, experienced driver with a clean record living in a low-risk area. Furthermore, the specific trim level and optional features of the 911 also influence the final cost.

A 911 Turbo S, with its higher performance capabilities, will naturally attract a higher premium than a base Carrera model.

Comparative Insurance Quotes

The following table presents hypothetical insurance quotes for a 2023 Porsche 911 Carrera S, assuming a 35-year-old driver with a clean driving record residing in a suburban area with average risk. These figures are for illustrative purposes only and should not be considered definitive.

| Insurance Company | Annual Premium (Comprehensive) | Annual Premium (Liability Only) | Key Coverage Differences |

|---|---|---|---|

| Company A (e.g., State Farm) | $2,500 | $1,200 | Offers roadside assistance, rental car reimbursement, and accident forgiveness. May have stricter requirements for driver profiles. |

| Company B (e.g., Geico) | $2,800 | $1,000 | Known for competitive liability rates. Comprehensive coverage might include limited options for classic car coverage, which could be a disadvantage for older 911 models. |

| Company C (e.g., Progressive) | $2,200 | $1,300 | Offers customizable coverage options, including various deductible levels. May have a more lenient approach to driver history. |

Coverage Options and Benefits

Each insurance company offers a range of coverage options, with varying levels of protection and associated costs. Comprehensive coverage typically includes collision, comprehensive (damage from events other than collisions), and liability coverage. Liability coverage protects against financial losses incurred due to accidents you cause.

Collision coverage protects your vehicle in case of an accident, regardless of fault. Comprehensive coverage extends to damage from events like theft, vandalism, and natural disasters. Benefits can include roadside assistance, rental car reimbursement, and accident forgiveness programs.

The specific benefits and their extent vary considerably across providers. For example, one insurer might offer a higher rental car reimbursement limit, while another might provide more extensive roadside assistance. It is crucial to compare the policy documents carefully to understand the nuances of each coverage option before making a decision.

Impact of Modifications on Insurance

Modifying a Porsche 911, a car already known for its performance capabilities, can significantly impact insurance premiums. Insurers assess risk based on a vehicle’s potential for accidents and the associated repair costs. Aftermarket modifications, even seemingly minor ones, can alter this risk profile, leading to higher premiums.

Understanding this relationship is crucial for owners planning modifications.Aftermarket modifications frequently increase the likelihood of accidents and inflate repair expenses, thereby escalating insurance costs. These modifications alter the car’s handling, performance, and value, all of which factor into the insurer’s risk assessment.

The extent of the premium increase depends on the type and extent of the modifications, the insurer, and the driver’s profile.

Performance Upgrades and Increased Premiums

Performance upgrades, such as turbochargers, superchargers, or engine remapping, dramatically increase a vehicle’s power and speed. This translates to a higher risk of accidents due to increased acceleration and potential for loss of control. Repair costs for a modified engine are also substantially higher than those for a standard engine.

For example, a high-performance turbocharger failure could easily cost tens of thousands of dollars to repair, significantly impacting the insurer’s potential payout. Consequently, insurers often impose substantial premium increases for vehicles with such modifications. A 20% to 50% increase in premiums isn’t uncommon for significant engine modifications, depending on the insurer and the specific modifications.

Custom Parts and Their Insurance Implications

The installation of custom body kits, spoilers, or other aesthetic modifications can also influence insurance costs. While these modifications might not directly affect performance, they can increase the cost of repairs in the event of an accident. Replacing a custom body kit is considerably more expensive than replacing a standard factory part.

Furthermore, some custom parts might not be readily available, extending repair times and further increasing costs for the insurer. Insurers may factor in the increased repair costs and potential delays into their premium calculations. For example, a custom carbon fiber body kit requiring specialized repair techniques and expensive replacement parts will likely result in a higher premium.

Disclosing Modifications to Your Insurer

Full transparency is paramount. Failing to disclose modifications to your insurer is a breach of contract and can invalidate your insurance coverage. If an accident occurs and undisclosed modifications are discovered, the insurer may refuse to pay out claims, leaving the owner responsible for all repair costs.

The process of disclosing modifications typically involves contacting your insurer and providing details about the modifications, including manufacturer details and installation dates. Some insurers may require photographic evidence or professional documentation of the modifications. It’s advisable to contact your insurer

before* making any modifications to understand the potential impact on your premiums and to ensure you are properly covered.

Factors Affecting Claims and Premiums

Insuring a Porsche 911, a high-performance vehicle, involves a complex interplay of factors that significantly influence both the frequency of claims and the resulting insurance premiums. Understanding these factors is crucial for prospective owners to manage their insurance costs effectively.

The relationship between claims history and premium pricing is fundamentally actuarial: more frequent or severe claims translate directly into higher premiums.The frequency and severity of claims directly impact future insurance premiums. Insurers use sophisticated actuarial models to assess risk.

A driver with a history of multiple accidents or significant claims will be considered a higher risk, leading to substantially increased premiums. Conversely, a clean claims history demonstrates lower risk and often results in significant discounts. The severity of a claim, measured by the cost of repairs or replacement, also plays a critical role.

A single, high-cost claim, such as a major collision, can have a more significant impact on premiums than several minor incidents. This is because the insurer’s payout is directly correlated to the premium calculation.

Claims Process for a Porsche 911

Filing a claim for a Porsche 911 typically involves a detailed process. Policyholders must promptly notify their insurer of the incident, providing all relevant information, including the date, time, location, and circumstances of the accident or damage. Crucially, comprehensive documentation is essential.

This includes police reports (if applicable), photographs of the damage, and contact information for all parties involved. Depending on the nature and severity of the damage, the insurer may require an appraisal from a qualified mechanic specializing in Porsche vehicles.

This appraisal will detail the extent of the damage and the associated repair costs. The insurer will then review the claim, assess liability, and determine the appropriate payout based on the policy coverage. Delays in providing required documentation can prolong the claims process.

In some cases, insurers may send investigators to assess the claim independently.

Impact of a Clean Driving Record on Premiums

Maintaining a clean driving record is paramount in securing favorable insurance rates for a Porsche 911. Insurers heavily weigh driving history when assessing risk. A driver with no accidents, traffic violations, or at-fault incidents will be considered a low-risk driver, resulting in significantly lower premiums compared to drivers with a history of incidents.

Many insurers offer significant discounts for drivers with spotless records, sometimes exceeding 20% or more off the base premium. This discount serves as a powerful incentive for safe driving practices and underscores the financial benefits of avoiding accidents and traffic violations.

For instance, a driver with five years of accident-free driving might qualify for a substantial discount, potentially saving thousands of dollars over the policy term.

Insurance Discounts and Savings

Securing affordable Porsche 911 insurance requires a strategic approach, leveraging available discounts to significantly reduce premiums. Several avenues exist for achieving substantial savings, impacting the overall cost of ownership. Understanding and actively pursuing these discounts is crucial for responsible budgeting.Numerous discounts are available to reduce the cost of insuring a Porsche 911.

These discounts often stack, leading to significant savings. The availability and specific percentage offered vary by insurer, so careful comparison shopping is essential.

Safe Driver Discounts

Safe driving habits are handsomely rewarded by most insurance providers. Discounts for accident-free driving records are common, with larger discounts offered for longer periods without incidents. For example, a driver with five years of accident-free driving might receive a 15-20% discount, while a driver with ten years could see a discount of 25% or more.

Insurers typically access driving records through state-mandated databases to verify eligibility. Maintaining a clean driving record is paramount for maximizing these savings.

Multi-Car Discounts

Insuring multiple vehicles with the same provider often qualifies for a multi-car discount. This discount reflects the reduced administrative overhead and perceived lower risk associated with insuring multiple vehicles under one policy. The discount percentage varies by insurer but typically ranges from 10% to 25%, depending on the number of vehicles and their respective risk profiles.

For instance, insuring a Porsche 911 and a family sedan with the same company might yield a 15% discount on the Porsche’s premium.

Bundling Discounts

Bundling home and auto insurance with a single provider often results in significant savings. This practice leverages economies of scale for the insurance company, leading to reduced administrative costs and potentially lower risk profiles. Discounts for bundling typically range from 10% to 20%, offering substantial savings when combined with other discounts.

A driver insuring both their home and their Porsche 911 with the same company might realize a combined discount of 20% or more.

Obtaining Discounts

The process of obtaining these discounts is generally straightforward. When applying for insurance or renewing a policy, clearly indicate all relevant factors, such as accident-free driving history, multiple vehicle ownership, and the intention to bundle policies. Providing accurate and complete information ensures eligibility for all applicable discounts.

Some insurers actively solicit information on these factors, while others may require documentation such as a driving record or home insurance policy. Proactively disclosing qualifying information maximizes the chances of securing the best possible rate.

Understanding Policy Terms and Conditions

Navigating the intricate world of Porsche 911 insurance requires a thorough understanding of the policy’s terms and conditions. These clauses, often buried within dense legal jargon, significantly impact coverage and the claims process. Failing to grasp these nuances can lead to unexpected costs and denied claims, even for seemingly straightforward incidents.

A comprehensive review is crucial for informed decision-making and financial protection.

Common Policy Terms

Insurance policies utilize specific terminology. Familiarizing yourself with these terms is paramount to understanding your rights and responsibilities. For instance, “deductible” refers to the amount the policyholder pays out-of-pocket before the insurance company begins coverage. “Premium” is the periodic payment made to maintain coverage.

“Liability coverage” protects against financial losses caused to others in an accident, while “collision coverage” covers damage to your Porsche 911 regardless of fault. “Comprehensive coverage” extends protection to damage caused by events other than collisions, such as theft or vandalism.

Understanding these basic terms forms the foundation for interpreting the more complex clauses.

Clauses Impacting Coverage

Several clauses within a Porsche 911 insurance policy can significantly influence coverage and claims payouts. For example, a “named driver” clause limits coverage to specified individuals. If an unauthorized driver causes an accident, the claim might be denied.

Similarly, “exclusion clauses” specify events or circumstances not covered by the policy. These could include damage caused by racing or driving under the influence of alcohol or drugs. “Subrogation” clauses allow the insurer to recover costs from a third party responsible for the damage to your vehicle.

This means that if another driver is at fault, your insurer might pursue reimbursement from their insurance company.

Importance of Policy Review

Thoroughly reviewing your Porsche 911 insurance policy is not merely advisable; it’s essential. Carefully reading the fine print ensures you understand the extent of your coverage, limitations, and the claims process. Disputes often arise from misunderstandings of policy terms.

By proactively reviewing your policy, you can identify potential gaps in coverage, allowing you to adjust your policy accordingly. This proactive approach ensures you receive the appropriate protection for your valuable asset and avoids costly surprises during a claim.

Seeking clarification from your insurer on unclear clauses is always recommended.

The Role of Safety Features in Insurance Costs

Insurers consider a vehicle’s safety features heavily when determining premiums. The presence of advanced safety technologies often translates to lower insurance costs, reflecting a reduced risk of accidents and lower potential repair bills. This is because these features actively mitigate the severity of collisions or even prevent them altogether.

The Porsche 911, known for its performance, also incorporates a range of safety systems, the impact of which varies across model years and specific options.The correlation between advanced safety features and lower insurance premiums is well-established. Features like multiple airbags, anti-lock braking systems (ABS), electronic stability control (ESC), and advanced driver-assistance systems (ADAS) demonstrably reduce the frequency and severity of accidents.

This translates directly into lower claim payouts for insurance companies, leading to lower premiums for policyholders.

Porsche 911 Safety Feature Impact on Insurance Costs

The impact of safety features on Porsche 911 insurance costs is nuanced, varying based on the specific features included and the model year. Generally, models equipped with more comprehensive safety suites command lower premiums.

- Base Model vs. Top-of-the-Line:A base model Porsche 911, while still possessing standard safety features like ABS and multiple airbags, will typically have higher insurance premiums compared to a higher-trim model equipped with features such as lane departure warning, adaptive cruise control, and automatic emergency braking.

The latter significantly reduces the likelihood of accidents, leading to lower risk assessment by insurers.

- Model Year Differences:Newer Porsche 911 models often incorporate more advanced safety technologies than older models. For example, a 2023 model might include advanced driver-assistance systems unavailable in a 2013 model. Consequently, the newer model will likely attract lower insurance premiums due to its enhanced safety profile.

- Optional Safety Packages:Porsche offers various optional safety packages that can significantly affect insurance costs. These packages often bundle together several advanced safety features, resulting in a potentially substantial reduction in premiums compared to purchasing the features individually. The cost savings from these packages often outweigh the initial added expense.

Safety Technology and Reduced Accident Rates

Numerous studies demonstrate a strong correlation between advanced safety features and reduced accident rates. Independent research by organizations such as the Insurance Institute for Highway Safety (IIHS) consistently shows that vehicles equipped with features like ESC, forward collision warning, and automatic emergency braking experience significantly fewer accidents, and those accidents that do occur are often less severe.

This reduction in accidents translates directly to lower insurance claims and, subsequently, lower insurance premiums for drivers. The data consistently shows that investing in safety technology results in a tangible return on investment, both in terms of enhanced personal safety and reduced insurance costs.

For example, studies have shown that ESC alone can reduce single-vehicle crashes by up to 30%.

Long-Term Cost of Ownership

Owning a Porsche 911, a symbol of automotive excellence, extends beyond the initial purchase price. The long-term financial commitment encompasses insurance premiums, which, like other ownership costs, can fluctuate significantly over time. Understanding these costs is crucial for prospective buyers to make informed decisions and budget effectively.The long-term cost of insuring a Porsche 911 over a 5-10 year period is substantial, influenced by a multitude of factors previously discussed, including model, driver profile, and location.

Predicting precise figures is challenging due to this variability; however, a realistic assessment can be achieved by considering average premiums and their potential trajectory.

Projected Insurance Cost Trajectory

A hypothetical graph illustrating insurance costs over a ten-year period would show a generally upward trend, though not necessarily linear. The initial years might exhibit relatively higher premiums due to the vehicle’s value and potential for higher claims. As the car ages, the premium might slightly decrease, reflecting a lower replacement cost.

However, factors like increased mileage or claims history could offset this decline. The graph would be a line chart with the x-axis representing years (0-10) and the y-axis representing annual insurance premiums (in USD). The line would likely start high, potentially plateau for a few years, and then show a slight downward trend in later years, with potential spikes reflecting specific events like claims.

Comparison of Ownership Expenses

To understand the weight of insurance costs within the broader context of Porsche 911 ownership, a comparison with other significant expenses is necessary. Maintenance and repairs are considerable, given the car’s sophisticated engineering and high-performance components. Routine servicing, specialized parts, and potential repairs can easily exceed several thousand dollars annually.

Fuel costs, especially considering the car’s powerful engine, also contribute significantly to the overall expense. Finally, depreciation, the loss of vehicle value over time, is a substantial factor, especially in the early years.

Hypothetical Budget for Total Cost of Ownership

Let’s consider a hypothetical example for a 2024 Porsche 911 Carrera, assuming an initial purchase price of $110,

Over ten years, a reasonable estimate might include:

| Expense Category | Annual Cost (USD) | Total Cost (USD) |

|---|---|---|

| Insurance | $3,000

|

$30,000

|

| Maintenance & Repairs | $2,000

|

$20,000

|

| Fuel | $2,000

|

$20,000

|

| Depreciation | $8,000

|

$80,000

|

This hypothetical budget illustrates that insurance represents a substantial, yet variable, portion of the total cost of ownership. While depreciation constitutes the largest single expense, the combined costs of insurance, maintenance, repairs, and fuel represent a significant ongoing commitment.

This emphasizes the importance of careful financial planning before purchasing a Porsche 911.

Conclusive Thoughts

Insuring a Porsche 911 demands careful consideration of numerous factors, extending beyond the sticker price. By understanding the nuances of model variations, driver profiles, coverage options, and geographic location, you can effectively manage your insurance costs. Remember to shop around, compare quotes, and leverage available discounts to minimize expenses while maximizing protection for your prized possession.

Proactive planning ensures you enjoy the thrill of the drive without the sting of unexpected insurance bills.