In today’s complex financial landscape, securing the right insurance coverage at the most competitive price is a challenge that many individuals face. The sheer volume of insurance providers and policy options can be overwhelming, leaving consumers grappling with a daunting task: finding the best deal. This is where insurance comparison websites step in, offering a streamlined and efficient solution to navigating this intricate world.

These platforms act as powerful tools, empowering consumers with the ability to compare quotes from multiple insurers in a single, centralized location. This eliminates the need to individually contact each provider, saving valuable time and effort. Moreover, comparison sites provide a clear and concise overview of policy features, coverage details, and pricing structures, enabling informed decision-making.

Insurance Comparison: Finding the Best Deal

In today’s competitive market, finding the best insurance deal can be a daunting task. With numerous insurance providers offering a wide range of plans and coverage options, navigating the complexities of insurance can feel overwhelming. However, comparing insurance options is crucial to ensure you’re getting the most comprehensive coverage at the most affordable price. This is where insurance comparison websites come into play, simplifying the process and empowering consumers to make informed decisions.

The Challenges of Finding the Best Insurance Deal

The search for the best insurance deal is often hampered by several challenges:

- Time-consuming: Manually comparing insurance quotes from multiple providers can be incredibly time-consuming, requiring you to spend hours researching and filling out forms.

- Confusing jargon: Insurance policies are often riddled with technical jargon and complex terms that can be difficult to understand, making it challenging to compare apples to apples.

- Limited information: Traditional methods of comparing insurance, such as relying on brochures or phone calls, often provide limited information, making it difficult to make informed decisions.

Insurance Comparison Websites: A Streamlined Solution

Insurance comparison websites provide a streamlined solution to these challenges, offering a centralized platform for comparing insurance quotes from various providers. These websites use advanced algorithms to analyze your specific needs and preferences, presenting you with personalized recommendations tailored to your unique circumstances.

Benefits of Using Insurance Comparison Sites

In today’s digital age, insurance comparison sites have become invaluable tools for consumers seeking the best deals on their insurance needs. These platforms offer a range of benefits, simplifying the insurance selection process and potentially saving you significant amounts of money.

Time-Saving Convenience

Comparison sites streamline the process of researching and comparing insurance quotes from multiple providers. Instead of contacting each insurer individually, you can input your information once and receive personalized quotes from various companies within minutes. This eliminates the need for extensive phone calls, emails, and paperwork, freeing up valuable time for other activities.

Key Features of Insurance Comparison Sites

Navigating the complex world of insurance can be daunting, but insurance comparison sites provide a valuable resource for consumers seeking the best deals and coverage. These platforms streamline the process by offering a centralized hub for comparing quotes from multiple insurers. However, not all comparison sites are created equal, and understanding the key features of a robust platform is crucial for making informed decisions.

User-Friendliness and Ease of Use

A user-friendly interface is essential for a seamless comparison experience. Effective insurance comparison sites prioritize intuitive navigation, clear search filters, and easily understandable information. Users should be able to quickly input their specific needs, such as coverage type, location, and desired deductible, and receive relevant results without encountering technical difficulties.

Comprehensive Coverage and Policy Options

A comprehensive comparison site should offer a wide range of insurance types, including auto, home, health, life, and renters insurance. This ensures users can compare quotes for various policies in one place, maximizing their options and facilitating informed choices. The site should also provide detailed information about each policy, including coverage details, exclusions, and potential add-ons.

Accurate Quotes and Transparency

Accurate quotes are paramount for making informed decisions. Reliable comparison sites utilize algorithms and data analysis to generate accurate quotes based on user-provided information. These sites should clearly display the factors influencing the quotes, such as age, driving history, credit score, and location, promoting transparency and trust.

Security and Data Privacy

Protecting user data is crucial for any online platform. Reputable insurance comparison sites employ robust security measures, including encryption protocols and secure data storage, to safeguard sensitive personal information. They should also adhere to industry-standard privacy practices and provide clear information about data collection, usage, and sharing policies.

Customer Support and Resources

Excellent customer support is essential for addressing user queries and resolving any issues that may arise. A good comparison site should offer multiple channels for customer support, such as phone, email, and live chat, with prompt response times. Additionally, they should provide comprehensive resources, including FAQs, guides, and articles, to empower users with the information they need to make informed decisions.

Types of Insurance Covered by Comparison Sites

Insurance comparison websites offer a comprehensive platform to compare various insurance policies from different providers, simplifying the process of finding the best deal. These platforms cover a wide range of insurance types, catering to diverse needs and financial situations.

Auto Insurance

Auto insurance is a necessity for vehicle owners, providing financial protection against potential risks such as accidents, theft, and damage. Comparison websites allow users to compare quotes from multiple insurers based on factors like vehicle type, driving history, location, and coverage options.

- Liability Coverage: This essential coverage protects you financially if you are at fault in an accident, covering the other driver’s medical expenses, property damage, and legal fees.

- Collision Coverage: This coverage reimburses you for repairs or replacement of your vehicle if it is damaged in an accident, regardless of fault.

- Comprehensive Coverage: This coverage protects your vehicle against damages from non-accident events such as theft, vandalism, fire, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who does not have insurance or has insufficient coverage.

Factors influencing auto insurance pricing include:

- Driving history: A clean driving record with no accidents or violations typically leads to lower premiums.

- Vehicle type: The make, model, and year of your vehicle affect its value and repair costs, influencing premiums.

- Location: Urban areas with higher traffic density and accident rates often have higher premiums.

- Coverage options: Choosing higher coverage limits or adding optional features such as roadside assistance can increase premiums.

Health Insurance

Health insurance is crucial for individuals and families to safeguard against unexpected medical expenses. Comparison websites help navigate the complex world of health plans, comparing coverage options, premiums, and deductibles.

- Health Maintenance Organization (HMO): HMO plans typically offer lower premiums but require members to use in-network providers. They often have lower out-of-pocket costs for preventive care and routine checkups.

- Preferred Provider Organization (PPO): PPO plans offer more flexibility in choosing providers, including both in-network and out-of-network options. They generally have higher premiums but lower deductibles.

- Exclusive Provider Organization (EPO): EPO plans are similar to HMOs but may offer slightly more flexibility in choosing providers. They typically have lower premiums than PPOs.

- Point-of-Service (POS): POS plans combine elements of HMOs and PPOs, allowing members to choose providers both in and out of network. They often have higher premiums than HMOs but lower deductibles than PPOs.

Factors influencing health insurance pricing include:

- Age: Older individuals generally have higher premiums due to increased healthcare needs.

- Location: Premiums vary depending on the cost of healthcare in different regions.

- Health status: Individuals with pre-existing conditions may face higher premiums.

- Tobacco use: Smokers typically have higher premiums.

Home Insurance

Home insurance protects homeowners against financial losses from various risks, including fire, theft, and natural disasters. Comparison websites enable homeowners to compare quotes from different insurers based on factors such as home value, location, and coverage options.

- Dwelling Coverage: This coverage reimburses you for repairs or replacement of your home’s structure in case of damage or destruction.

- Personal Property Coverage: This coverage protects your belongings inside your home, such as furniture, electronics, and clothing.

- Liability Coverage: This coverage protects you financially if someone is injured on your property or if your property causes damage to others.

- Additional Living Expenses Coverage: This coverage helps cover temporary living expenses if you are unable to live in your home due to damage or destruction.

Factors influencing home insurance pricing include:

- Home value: Higher home values typically lead to higher premiums.

- Location: Homes in areas with higher risk of natural disasters or crime may have higher premiums.

- Construction type: Homes made of fire-resistant materials may have lower premiums.

- Coverage options: Choosing higher coverage limits or adding optional features such as flood or earthquake insurance can increase premiums.

Life Insurance

Life insurance provides financial security to loved ones in the event of your death. Comparison websites allow users to compare quotes from different insurers based on factors such as age, health, and coverage amount.

- Term Life Insurance: This type of insurance provides coverage for a specific period, typically 10 to 30 years. Premiums are generally lower than permanent life insurance, but there is no cash value accumulation.

- Whole Life Insurance: This type of insurance provides lifetime coverage and includes a cash value component that accumulates over time. Premiums are generally higher than term life insurance.

- Universal Life Insurance: This type of insurance offers flexible premiums and death benefits, allowing policyholders to adjust their coverage needs over time. It also includes a cash value component.

- Variable Life Insurance: This type of insurance invests the cash value component in mutual funds, allowing for potential growth but also exposing policyholders to market risks.

Factors influencing life insurance pricing include:

- Age: Younger individuals typically have lower premiums than older individuals.

- Health: Individuals with pre-existing conditions may face higher premiums.

- Lifestyle: Individuals who engage in risky activities may have higher premiums.

- Coverage amount: Higher coverage amounts typically lead to higher premiums.

Travel Insurance

Travel insurance provides financial protection against unexpected events that may occur during a trip, such as medical emergencies, trip cancellations, and lost luggage. Comparison websites help travelers find the best coverage options based on their destination, trip duration, and budget.

- Medical Coverage: This coverage helps pay for medical expenses incurred during a trip, including emergency medical evacuation.

- Trip Cancellation/Interruption Coverage: This coverage reimburses you for non-refundable trip expenses if you have to cancel or interrupt your trip due to unforeseen circumstances.

- Baggage Coverage: This coverage provides protection against lost, stolen, or damaged luggage.

- Travel Delay Coverage: This coverage helps cover expenses incurred due to travel delays, such as missed connections or weather disruptions.

Factors influencing travel insurance pricing include:

- Destination: Trips to high-risk destinations may have higher premiums.

- Trip duration: Longer trips typically have higher premiums.

- Age: Older travelers may face higher premiums.

- Coverage options: Choosing higher coverage limits or adding optional features such as adventure sports coverage can increase premiums.

How to Choose the Best Insurance Comparison Site

Navigating the world of insurance can be a daunting task, with numerous providers offering a wide range of plans and coverage options. Fortunately, insurance comparison sites have emerged as invaluable tools for consumers seeking the best deals. However, with so many comparison sites available, choosing the right one is crucial to ensure you’re getting the most accurate and comprehensive results.

Factors to Consider When Choosing an Insurance Comparison Site

Selecting the best insurance comparison site for your needs involves considering several key factors. This includes evaluating the site’s coverage options, ease of use, customer support, and overall reputation.

- Types of Insurance Covered: Different comparison sites specialize in different types of insurance. Ensure the site you choose covers the specific insurance you’re looking for, such as car, home, health, or life insurance.

- Coverage Options: Consider the breadth of coverage options offered by the comparison site. Some sites may only offer basic plans, while others may provide a wider selection of plans with varying levels of coverage.

- Ease of Use: The comparison site should be easy to navigate and use. The site should have a clear and intuitive interface that allows you to easily search for quotes, compare plans, and enter your personal information.

- Customer Support: Look for a comparison site that offers reliable customer support. This can be helpful if you have questions about the comparison process, insurance policies, or need assistance with a specific issue.

- Reputation and Credibility: Before using any comparison site, it’s essential to research its reputation and credibility. Check online reviews, independent ratings, and industry awards to get a sense of the site’s reliability and trustworthiness.

Tips for Evaluating the Credibility of Insurance Comparison Sites

Evaluating the credibility of an insurance comparison site is crucial to ensure you’re getting accurate and reliable information. Consider these tips:

- Check for Licensing and Certifications: Ensure the comparison site is licensed and certified by relevant regulatory bodies. This indicates that the site adheres to industry standards and practices.

- Look for Transparency in Data: Reputable comparison sites are transparent about their data sources and methodology. They should clearly state how they collect and analyze insurance quotes and provide information about their partners and insurance providers.

- Read User Reviews and Testimonials: Check online reviews and testimonials from other users to get insights into the site’s performance, customer service, and overall user experience.

- Verify Information: It’s always a good practice to verify the information provided by the comparison site with the insurance provider directly. This helps ensure the accuracy of the quotes and plan details.

Comparing Different Comparison Site Options

When comparing different insurance comparison sites, consider their pros and cons to determine the best fit for your needs.

- Specialized Sites: These sites focus on specific types of insurance, such as car insurance or health insurance. They offer a deeper understanding of the niche market and provide more tailored comparisons.

- General Comparison Sites: These sites offer a wider range of insurance products, including car, home, health, and life insurance. They provide a comprehensive overview of different options but may not offer the same level of specialization as niche sites.

- Direct Insurance Provider Websites: Some insurance providers have their own comparison tools on their websites. This allows you to compare different plans within the same company, but it may not provide a comprehensive overview of the market.

Tips for Using Insurance Comparison Sites Effectively

Insurance comparison websites can be a valuable tool for finding the best insurance deals. However, to maximize their effectiveness, it’s crucial to use them strategically and be aware of their limitations.

Entering Accurate Information

Providing accurate information is paramount to receiving relevant and accurate quotes.

- Ensure you enter your correct personal details, including your name, address, date of birth, and contact information.

- Be precise about your vehicle details (make, model, year, mileage) if you’re comparing car insurance.

- Clearly state your home’s details (address, size, value) for home insurance comparisons.

- Specify your health history and lifestyle choices when comparing health insurance.

Inaccurate information can lead to inaccurate quotes, wasting your time and potentially resulting in a policy that doesn’t meet your needs.

Exploring Various Options

Don’t settle for the first few quotes you see.

- Explore different insurance providers and coverage options.

- Adjust your coverage levels and deductibles to see how they impact premiums.

- Consider adding or removing optional features like roadside assistance or rental car coverage.

By comparing a wide range of options, you can identify the best value for your specific circumstances.

Comparing Quotes Carefully

When comparing quotes, don’t just focus on the price.

- Review the coverage details carefully, ensuring they meet your needs.

- Pay attention to deductibles and policy limits.

- Compare the customer service ratings and claims handling processes of different insurers.

The cheapest policy might not be the best if it lacks essential coverage or has a poor reputation for customer service.

Reading Policy Details

Once you’ve chosen a policy, take the time to read the policy document thoroughly.

- Understand the terms and conditions, including exclusions and limitations.

- Pay attention to any specific requirements or obligations you need to fulfill.

- Don’t hesitate to contact the insurer if you have any questions or need clarification.

This step helps avoid misunderstandings and ensures you’re fully aware of the coverage you’re getting.

Understanding Coverage Limitations

Insurance policies are designed to protect you against specific risks.

- Be aware of the coverage limitations and exclusions Artikeld in your policy.

- For example, a standard homeowner’s insurance policy might not cover floods or earthquakes.

- Consider additional coverage options if you have specific concerns or live in a high-risk area.

Knowing your policy’s limitations helps you make informed decisions about your insurance needs.

Negotiating Better Insurance Rates

While comparison websites provide a good starting point, there are still opportunities to negotiate better rates.

- Contact the insurers directly and discuss your specific needs and circumstances.

- Highlight any safety features or risk-reducing measures you’ve implemented, such as security systems or driving safety courses.

- Inquire about discounts for bundling policies or for being a loyal customer.

By being proactive and engaging in open communication, you might be able to secure a more favorable rate.

Factors to Consider When Choosing Insurance

Insurance premiums are calculated based on a variety of factors that assess your risk profile. Understanding these factors can help you make informed decisions about your insurance coverage and potentially save money.

Factors Influencing Insurance Pricing

Insurance companies use a complex system to determine premiums, taking into account several factors. These factors vary depending on the type of insurance but generally include:

- Age: Younger drivers tend to have higher premiums because they have less driving experience. Conversely, older drivers may pay more due to increased risk of health issues.

- Location: Insurance premiums are influenced by the location where you live. Areas with higher crime rates or more traffic congestion may have higher premiums.

- Driving History: Your driving history, including accidents, tickets, and driving violations, significantly impacts your insurance rates. A clean driving record typically results in lower premiums.

- Health Status: For health insurance, your medical history, current health conditions, and lifestyle choices, such as smoking, can influence your premium.

Impact of Deductibles, Coverage Limits, and Policy Terms

Deductibles, coverage limits, and policy terms play a crucial role in determining your insurance costs.

- Deductibles: A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles generally result in lower premiums, as you are taking on more financial risk.

- Coverage Limits: Coverage limits define the maximum amount your insurance company will pay for a covered event. Higher coverage limits typically result in higher premiums.

- Policy Terms: Policy terms, such as the duration of coverage and specific exclusions, can impact your premium.

Impact of Personal Circumstances and Risk Profiles

Your personal circumstances and risk profile can also significantly affect your insurance premiums.

- Credit Score: In some states, insurance companies consider your credit score when determining premiums. A higher credit score may lead to lower premiums.

- Marital Status: Married individuals often receive lower insurance premiums, as they are statistically considered to be less risky drivers.

- Occupation: Certain occupations may increase your risk of accidents or injuries, leading to higher insurance premiums.

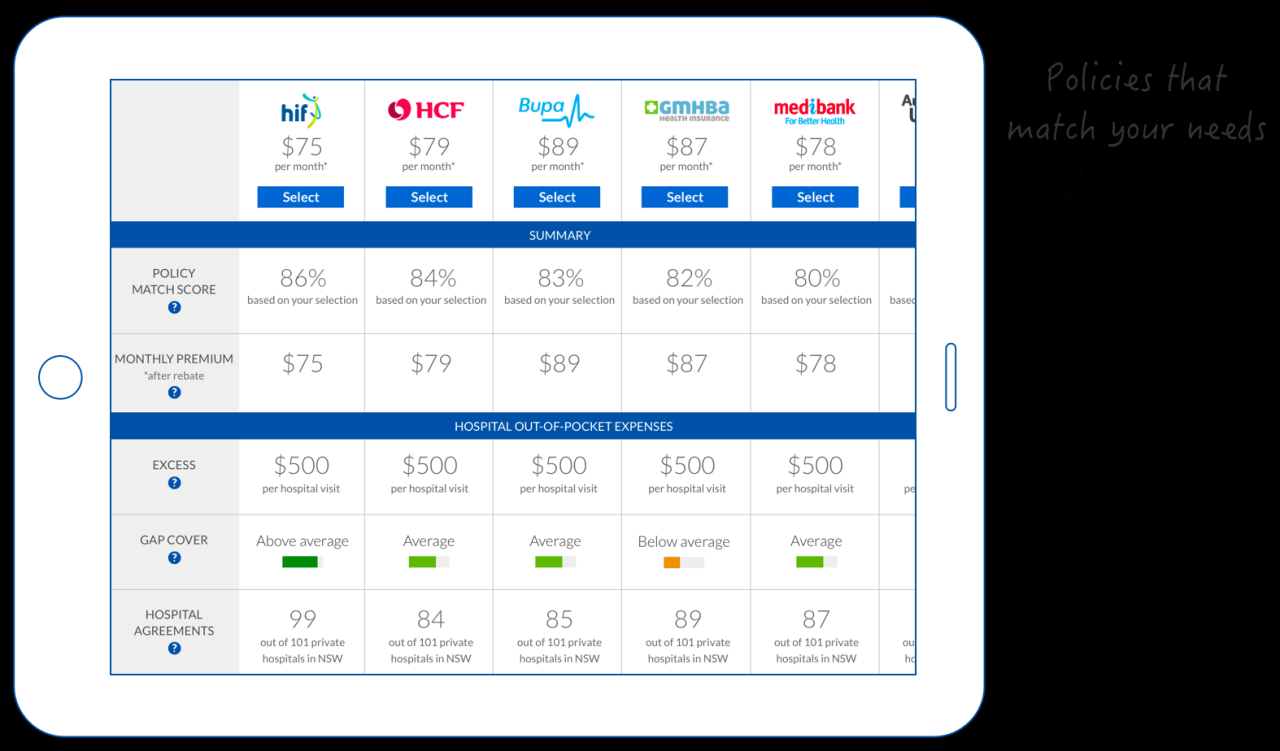

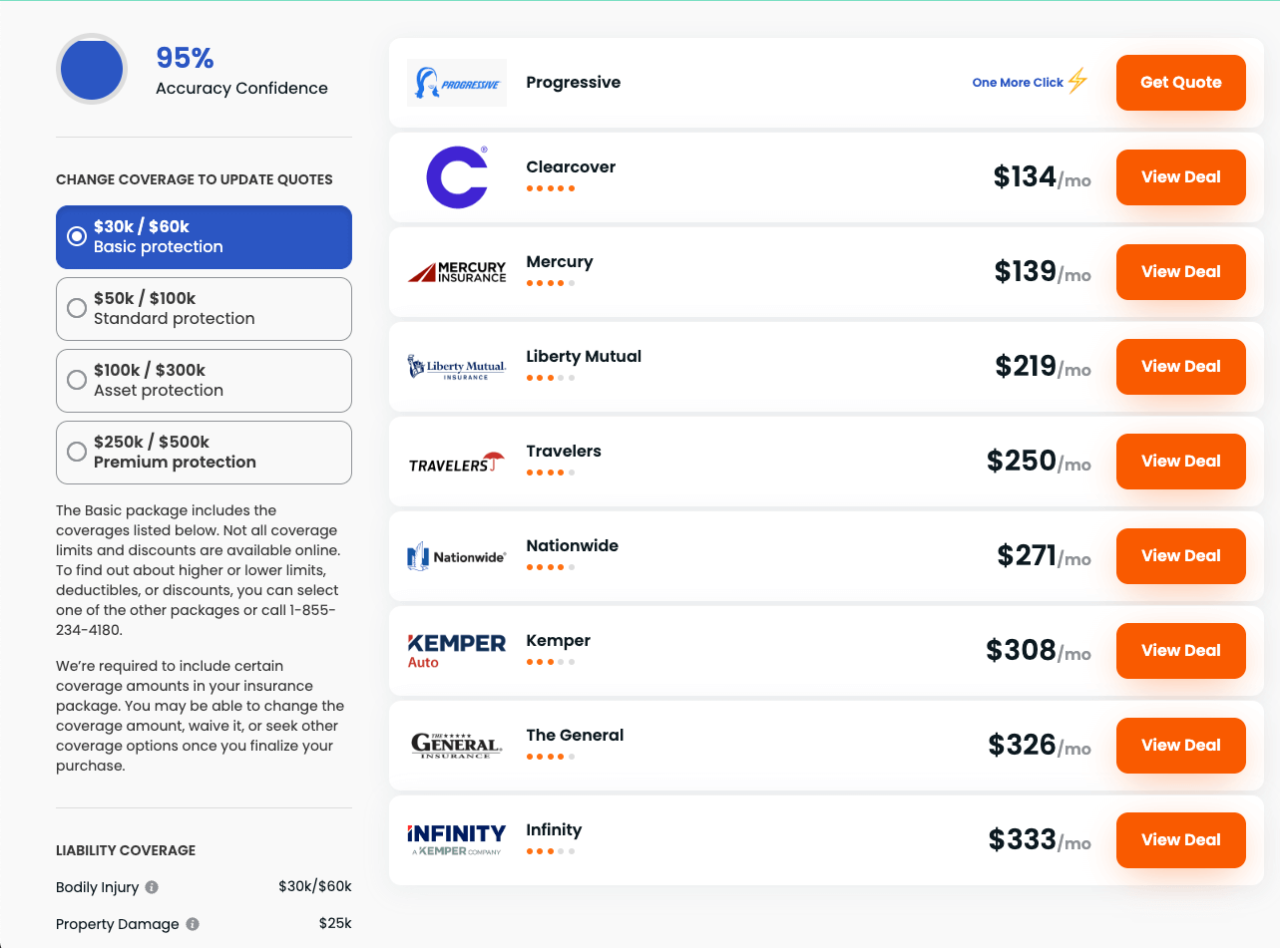

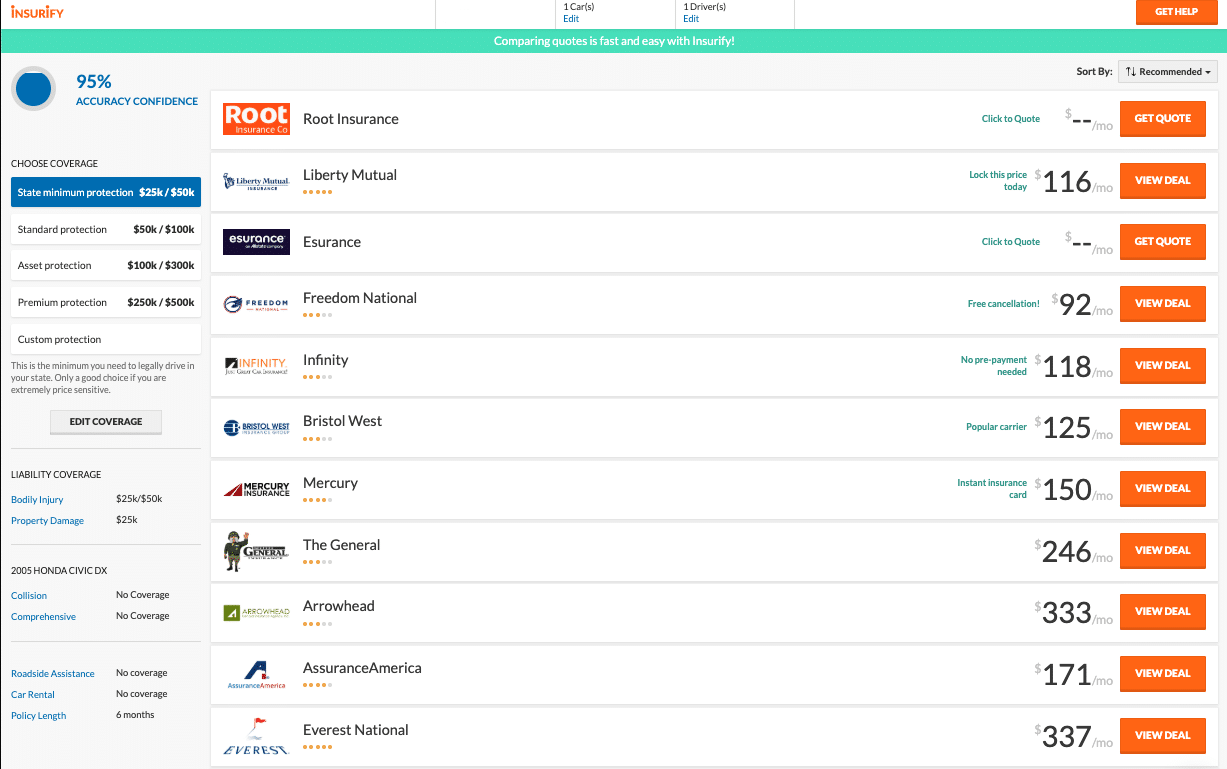

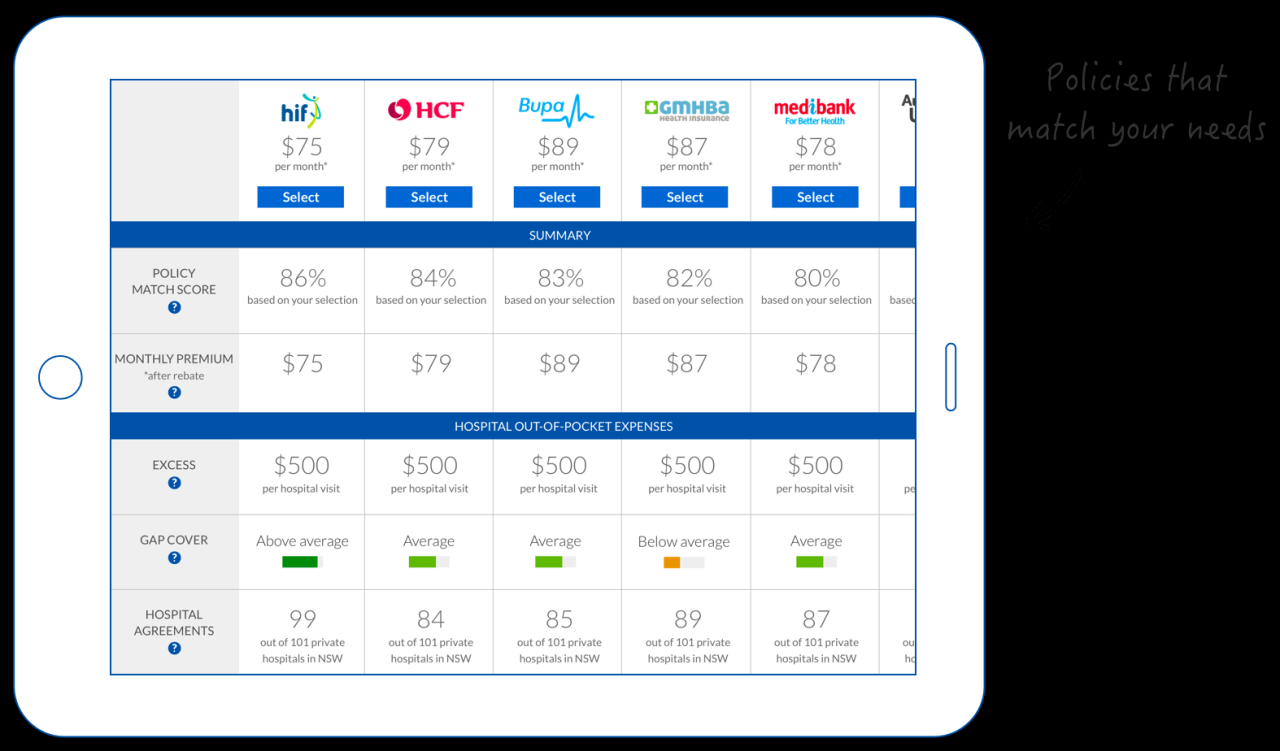

Real-World Examples of Insurance Comparison Sites

The insurance comparison landscape is populated by numerous websites, each offering a unique set of features and benefits. These platforms simplify the insurance search process by allowing users to compare quotes from multiple providers simultaneously. This saves time and effort, enabling consumers to find the most suitable and cost-effective insurance policies.

Popular Insurance Comparison Websites

A comprehensive understanding of the available options requires exploring the strengths and weaknesses of prominent insurance comparison websites. This section presents a table comparing four leading platforms:

| Website | Key Features | Pros | Cons |

|---|---|---|---|

| Policygenius |

|

|

|

| NerdWallet |

|

|

|

| The Zebra |

|

|

|

| Insurify |

|

|

|

Conclusion

In today’s competitive insurance market, insurance comparison sites have become invaluable tools for consumers seeking the best deals. By leveraging these platforms, individuals can save significant amounts of money on their insurance premiums while finding the most suitable coverage for their needs.

Key Takeaways

Insurance comparison sites empower consumers by:

- Providing a convenient and efficient way to compare quotes from multiple insurers.

- Offering a comprehensive overview of available insurance options, allowing for informed decision-making.

- Enabling users to customize their search criteria based on their specific requirements.

- Helping users identify potential savings and uncover hidden discounts.

Ultimately, the decision of whether to use an insurance comparison site lies with the individual. However, given the numerous benefits they offer, it is highly recommended to explore these platforms before committing to any insurance policy.

Final Wrap-Up

The rise of insurance comparison websites has fundamentally changed the way individuals approach insurance planning. These platforms provide a level playing field, empowering consumers with the knowledge and tools necessary to make informed decisions. By leveraging the power of comparison, individuals can secure the best possible insurance coverage at a price that aligns with their financial needs. As the insurance landscape continues to evolve, these platforms are poised to play an even more significant role in helping consumers navigate the complex world of insurance.