Minnesota’s car insurance market is a complex landscape, with unique regulations and factors influencing premiums. From understanding mandatory coverage requirements to navigating the intricacies of the state’s no-fault system, navigating the process can be daunting for both new and seasoned drivers. This comprehensive guide aims to demystify Minnesota car insurance, providing insights into key considerations, cost-saving strategies, and essential resources to help you make informed decisions.

This exploration delves into the critical elements of Minnesota car insurance, covering topics ranging from the impact of driving history and vehicle type on premiums to the intricacies of filing claims and exploring driver safety programs. We’ll also examine the benefits and limitations of the state’s no-fault system, shedding light on the role of Personal Injury Protection (PIP) and how it impacts accident claims.

Understanding Minnesota Car Insurance Basics

Navigating the world of car insurance in Minnesota can be daunting, especially for newcomers. This guide will equip you with the essential knowledge to understand the mandatory coverage requirements, penalties for non-compliance, and the different types of insurance available to you.

Mandatory Car Insurance Coverage Requirements in Minnesota

The state of Minnesota mandates specific car insurance coverage for all drivers. These requirements are designed to ensure financial protection for drivers and victims of accidents.

- Liability Coverage: This coverage protects you financially if you are at fault in an accident. It covers the other driver’s medical expenses, property damage, and lost wages. The minimum liability coverage requirements in Minnesota are:

- Bodily Injury Liability: $30,000 per person, $60,000 per accident

- Property Damage Liability: $10,000 per accident

- No-Fault Coverage: This coverage pays for your medical expenses and lost wages regardless of who is at fault in an accident. Minnesota’s no-fault coverage requirement is $20,000 per person.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who does not have insurance or has insufficient coverage. The minimum requirement for this coverage is the same as your liability coverage limits.

Penalties for Driving Without Car Insurance in Minnesota

Driving without the required car insurance in Minnesota can lead to serious consequences, including:

- Fines: You can be fined up to $1,000 for driving without insurance.

- License Suspension: Your driver’s license can be suspended for up to one year.

- Vehicle Impoundment: Your vehicle can be impounded until you provide proof of insurance.

- Court Costs: You may have to pay court costs and other legal fees.

Types of Car Insurance Coverage Available in Minnesota

While the state mandates certain coverage, there are various additional insurance options you can choose from to further protect yourself and your vehicle.

- Collision Coverage: This coverage pays for repairs to your vehicle if it is damaged in an accident, regardless of who is at fault.

- Comprehensive Coverage: This coverage pays for repairs to your vehicle if it is damaged by something other than an accident, such as theft, vandalism, or a natural disaster.

- Medical Payments Coverage: This coverage pays for your medical expenses, regardless of who is at fault in an accident.

- Personal Injury Protection (PIP): This coverage pays for your lost wages and other expenses if you are injured in an accident.

- Rental Reimbursement: This coverage pays for a rental car while your vehicle is being repaired after an accident.

- Roadside Assistance: This coverage provides assistance for things like flat tires, jump starts, and towing.

Common Car Insurance Exclusions in Minnesota

It’s important to understand that car insurance policies often have exclusions, which are situations where coverage may not apply. Some common exclusions in Minnesota include:

- Driving Under the Influence (DUI): Insurance companies generally do not cover accidents that occur while the driver is under the influence of alcohol or drugs.

- Intentional Acts: Insurance companies do not cover damages caused by intentional acts, such as driving recklessly or intentionally damaging your own vehicle.

- Unlicensed Drivers: Insurance companies typically do not cover accidents involving drivers who are not licensed to operate a vehicle.

- Certain Types of Vehicles: Some insurance companies may exclude coverage for certain types of vehicles, such as motorcycles, ATVs, or commercial vehicles.

Factors Influencing Car Insurance Premiums in Minnesota

Car insurance premiums in Minnesota are determined by a multitude of factors, with each contributing to the overall cost. These factors are carefully considered by insurance companies to assess the risk associated with insuring a particular driver and vehicle.

Driving History

A driver’s history plays a significant role in determining car insurance premiums. Insurance companies use driving records to evaluate the risk associated with insuring a particular driver.

- Accidents: Drivers with a history of accidents tend to have higher premiums. The number, severity, and recency of accidents all factor into the calculation.

- Traffic Violations: Traffic violations, such as speeding tickets, reckless driving, and DUI convictions, can significantly increase premiums. These violations indicate a higher risk of future accidents.

- Driving Experience: Drivers with less experience are generally considered to be at a higher risk. Premiums are often higher for younger drivers or those with limited driving experience.

Vehicle Type and Age

The type and age of a vehicle can significantly impact car insurance premiums.

- Vehicle Type: Sports cars and high-performance vehicles are typically more expensive to insure due to their higher risk of accidents and repair costs.

- Vehicle Age: Older vehicles tend to have lower premiums compared to newer vehicles. This is because older vehicles are generally less expensive to repair or replace in the event of an accident.

Geographic Location

Car insurance premiums can vary significantly based on the geographic location within Minnesota.

- Urban vs. Rural: Premiums tend to be higher in urban areas compared to rural areas due to higher traffic density and increased risk of accidents.

- Crime Rates: Areas with higher crime rates generally have higher premiums as the risk of vehicle theft and vandalism is increased.

- Weather Conditions: Areas with harsh weather conditions, such as heavy snow or frequent hailstorms, may have higher premiums due to the increased risk of accidents and vehicle damage.

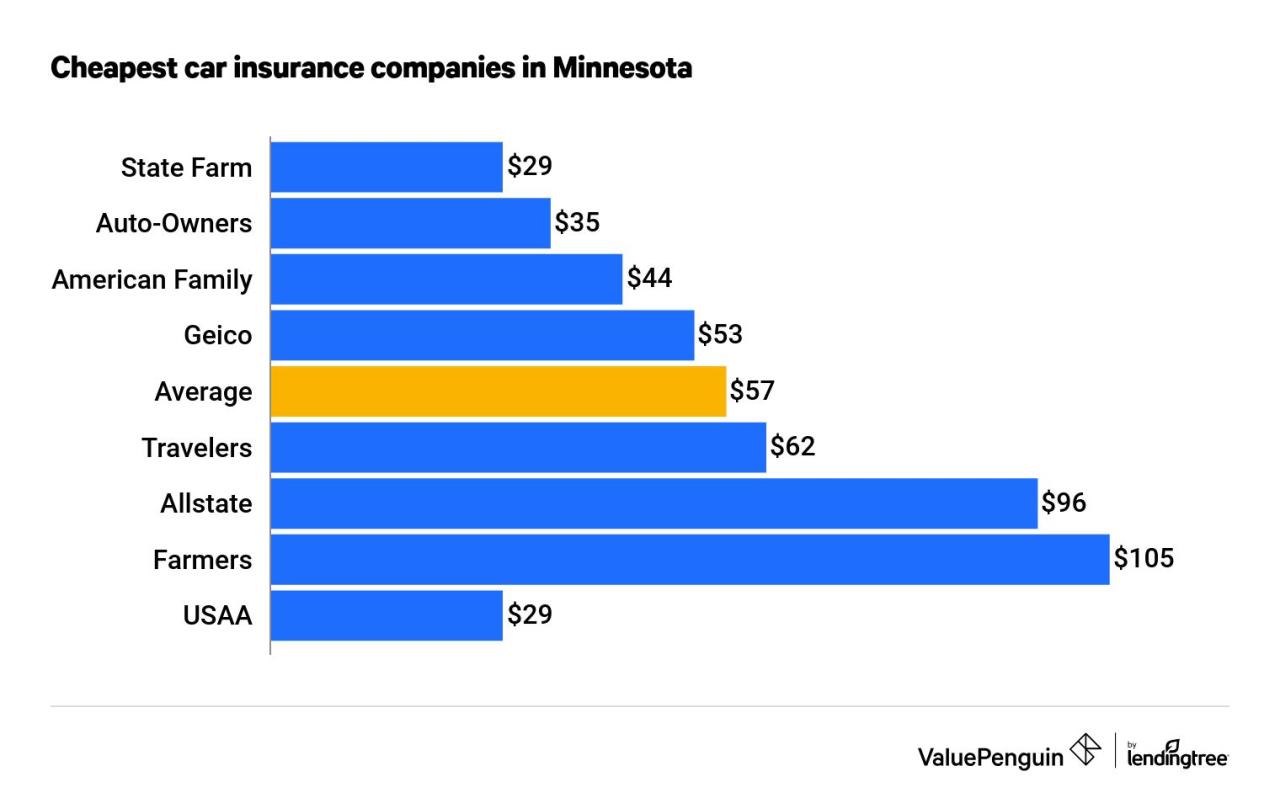

Finding Affordable Car Insurance in Minnesota

Securing affordable car insurance in Minnesota is crucial for every driver. With a competitive insurance market, finding the best rates can be challenging. This section will provide insights into finding the most affordable options for your needs.

Comparing Top Car Insurance Providers in Minnesota

To help you make an informed decision, here’s a comparison of the top 5 car insurance providers in Minnesota, based on price, customer service, and coverage options:

| Provider | Price | Customer Service | Coverage Options |

|—|—|—|—|

| State Farm | Generally affordable | High customer satisfaction ratings | Comprehensive coverage options, including roadside assistance, rental car reimbursement, and accident forgiveness |

| Progressive | Competitive rates | Known for its online tools and resources | Customizable coverage options, including personalized discounts |

| American Family Insurance | Competitive pricing | Positive customer reviews | Comprehensive coverage options, including accident forgiveness and ride-sharing coverage |

| Farmers Insurance | Affordable rates | Strong customer service reputation | Wide range of coverage options, including gap insurance and personal injury protection |

| USAA | Competitive rates, especially for military members | Excellent customer service | Comprehensive coverage options, including accident forgiveness and roadside assistance |

Finding Affordable Car Insurance Quotes in Minnesota

Obtaining multiple quotes from different insurance providers is crucial for finding the best deal. Here’s a step-by-step guide:

1. Gather Your Information: Before requesting quotes, have your driver’s license, vehicle registration, and previous insurance information readily available.

2. Utilize Online Quote Tools: Many insurance providers offer online quote tools, allowing you to compare rates quickly and easily.

3. Contact Multiple Providers: Don’t limit yourself to just a few providers. Reach out to several companies to get a diverse range of quotes.

4. Compare Quotes Carefully: Review each quote carefully, paying attention to coverage details, deductibles, and premiums.

5. Ask Questions: If you have any questions about a particular quote, don’t hesitate to contact the provider directly.

Negotiating Lower Car Insurance Premiums in Minnesota

Once you have several quotes, you can use negotiation tactics to potentially secure lower premiums:

1. Bundle Your Policies: Combining your car insurance with other policies, such as homeowners or renters insurance, can lead to significant discounts.

2. Increase Your Deductible: Choosing a higher deductible can lower your premium, but remember that you’ll be responsible for a larger out-of-pocket expense in the event of an accident.

3. Improve Your Credit Score: A good credit score can sometimes result in lower insurance premiums.

4. Shop Around Regularly: Re-evaluating your insurance policy every year or two can help you find better rates.

Car Insurance Discounts Available in Minnesota

Many insurance companies offer discounts to eligible drivers. Here are some common examples:

* Good Driver Discount: Maintaining a clean driving record with no accidents or traffic violations can earn you a discount.

* Safe Driver Discount: Participating in defensive driving courses or having a telematics device installed in your vehicle can lower your premium.

* Multi-Car Discount: Insuring multiple vehicles with the same provider can result in a discount.

* Student Discount: Good students with high GPAs may qualify for a discount.

* Military Discount: Active military personnel or veterans may be eligible for special discounts.

* Homeowner Discount: Bundling your car insurance with homeowners or renters insurance can lead to savings.

* Loyalty Discount: Long-term customers may receive a discount for their continued business.

Understanding Minnesota’s No-Fault System

Minnesota operates under a no-fault insurance system, which means that drivers are primarily responsible for covering their own medical expenses and lost wages following an accident, regardless of who caused the accident. This system aims to streamline the claims process and reduce litigation.

Benefits of Minnesota’s No-Fault System

The no-fault system in Minnesota offers several benefits, including:

- Faster Claims Processing: No-fault insurance allows drivers to file claims with their own insurer, regardless of who caused the accident. This simplifies the claims process and speeds up payment for medical expenses and lost wages.

- Reduced Litigation: By requiring drivers to seek compensation from their own insurer, the no-fault system aims to reduce the number of lawsuits arising from accidents. This can help lower insurance costs in the long run.

- Guaranteed Coverage: No-fault insurance guarantees that drivers will receive coverage for their own medical expenses and lost wages, regardless of who caused the accident. This provides peace of mind and ensures that individuals are not left financially vulnerable after an accident.

Limitations of Minnesota’s No-Fault System

While the no-fault system offers several benefits, it also has some limitations:

- Limited Compensation: The no-fault system sets limits on the amount of compensation available for medical expenses and lost wages. These limits can be insufficient for individuals with serious injuries or extended recovery periods.

- No Compensation for Pain and Suffering: The no-fault system generally does not provide compensation for pain and suffering, emotional distress, or other non-economic damages.

- Potential for Disputes: Disputes can arise when determining fault for an accident, especially when multiple parties are involved. This can lead to delays in claims processing and increase the likelihood of litigation.

Personal Injury Protection (PIP) in Minnesota’s No-Fault System

Personal Injury Protection (PIP) is a mandatory coverage in Minnesota’s no-fault system. PIP covers the following expenses for the insured and their family members:

- Medical Expenses: PIP covers reasonable and necessary medical expenses, including hospital bills, doctor’s visits, physical therapy, and prescription drugs.

- Lost Wages: PIP provides compensation for lost wages due to a covered injury, up to a specified limit.

- Other Expenses: PIP may cover other expenses related to the injury, such as funeral costs or transportation.

Situations Where a Driver May Need to File a Claim Under Minnesota’s No-Fault System

Drivers may need to file a claim under Minnesota’s no-fault system in the following situations:

- Medical Expenses: If a driver sustains injuries in an accident, they can file a PIP claim with their own insurer to cover their medical expenses.

- Lost Wages: If a driver is unable to work due to injuries sustained in an accident, they can file a PIP claim to receive compensation for lost wages.

- Other Expenses: Drivers can file a PIP claim to cover other expenses related to their injuries, such as funeral costs or transportation.

Navigating Car Insurance Claims in Minnesota

Filing a car insurance claim in Minnesota can be a complex process, but understanding the steps involved and your rights as a policyholder can make the experience smoother. This section will guide you through the process of filing a claim, interacting with insurance adjusters, and navigating potential disputes.

Filing a Car Insurance Claim

After a car accident, it is crucial to report the incident to your insurance company as soon as possible. This helps initiate the claims process and ensures timely assistance. Here are the steps involved in filing a car insurance claim in Minnesota:

- Contact Your Insurance Company: Inform your insurance company about the accident, providing details such as the date, time, location, and parties involved. Most insurance companies offer 24/7 claims reporting services through their website or phone lines.

- Gather Information: Collect all relevant information from the accident scene, including the other driver’s contact information, insurance details, and any witness statements. Take photographs of the damage to your vehicle and the accident scene.

- File a Claim: Your insurance company will provide you with a claim form that you need to complete and submit. This form typically requires details about the accident, your vehicle, and any injuries sustained.

- Cooperate with the Adjuster: Once your claim is filed, an insurance adjuster will contact you to investigate the accident and assess the damage. It is important to cooperate fully with the adjuster, providing them with all necessary documentation and information.

- Negotiate a Settlement: The insurance adjuster will determine the amount of compensation you are eligible for based on your policy coverage and the severity of the damage. You have the right to negotiate this settlement if you believe it is unfair.

Dealing with Insurance Adjusters

Insurance adjusters play a crucial role in the claims process, assessing the damage and determining the amount of compensation you are eligible for. While their job is to protect the insurance company’s interests, you have the right to advocate for yourself and ensure you receive fair treatment.

- Understand Your Rights: Familiarize yourself with your rights as a policyholder in Minnesota. You have the right to receive prompt and fair treatment from your insurance company.

- Document All Communication: Keep detailed records of all communication with the insurance adjuster, including dates, times, and the content of conversations. This documentation can be valuable if any disputes arise.

- Be Prepared to Negotiate: Insurance adjusters are often skilled negotiators, so be prepared to negotiate a settlement that you feel is fair. You can consult with a lawyer or an independent insurance adjuster for assistance.

- Don’t Settle Too Quickly: Take your time to review the settlement offer carefully before accepting it. Consider the cost of repairs, medical expenses, and any other losses you have incurred.

Documenting Car Accidents

Proper documentation of a car accident is crucial for ensuring a smooth claims process and maximizing your chances of receiving fair compensation. This includes:

- Take Photographs: Capture detailed photographs of the accident scene, including the damage to all vehicles involved, any skid marks, and any surrounding objects.

- Gather Contact Information: Collect contact information from all parties involved, including drivers, passengers, and witnesses.

- Obtain Police Report: If the accident involves injuries or property damage exceeding a certain threshold, it is essential to file a police report.

- Record Witness Statements: If there are any witnesses, obtain their contact information and ask them to provide written statements about what they observed.

- Keep a Detailed Account: Maintain a detailed written account of the accident, including the date, time, location, and any other relevant details.

Common Car Insurance Claim Disputes

While most car insurance claims are settled amicably, disputes can arise. Some common areas of disagreement include:

- Valuation of Damage: Disputes can occur regarding the fair market value of a damaged vehicle or the cost of repairs.

- Liability: Determining fault for the accident can be a source of contention, particularly in cases where multiple vehicles are involved.

- Medical Expenses: Insurance companies may challenge the necessity or reasonableness of medical expenses incurred as a result of the accident.

- Lost Wages: Claims for lost wages due to injuries sustained in the accident may be disputed.

Minnesota’s Driver Safety Programs

Minnesota recognizes the importance of safe driving practices and offers various driver safety programs aimed at enhancing driver skills and reducing accidents. These programs cater to different needs, from new drivers to experienced individuals looking to refresh their knowledge.

Benefits of Participating in Driver Safety Programs

Participation in driver safety programs in Minnesota offers numerous benefits for both drivers and the overall road safety environment. These programs are designed to:

- Enhance driving skills: These programs provide drivers with updated knowledge on traffic laws, defensive driving techniques, and safe driving practices, helping them become more confident and skilled drivers.

- Reduce the risk of accidents: By equipping drivers with the necessary skills and awareness, these programs aim to minimize the chances of accidents, contributing to a safer driving environment for everyone.

- Lower insurance premiums: Completing a driver safety course can lead to discounts on car insurance premiums, making it a financially beneficial decision for drivers.

- Improve driver attitudes: Driver safety programs often emphasize responsible driving behavior and the importance of safe driving practices, encouraging drivers to adopt a more cautious and considerate approach on the road.

Types of Driver Safety Courses Available in Minnesota

Minnesota offers a variety of driver safety courses to cater to diverse needs and driving experiences. Some of the most common courses include:

- Defensive Driving Courses: These courses teach drivers how to anticipate and avoid potential hazards on the road, emphasizing defensive driving techniques and strategies.

- Teen Driver Education Programs: Designed specifically for young drivers, these programs provide essential driving skills, knowledge of traffic laws, and risk management techniques.

- Senior Driver Refresher Courses: These courses help older drivers stay up-to-date with current traffic laws, driving techniques, and address any age-related changes in driving abilities.

- Driver Improvement Courses: These courses are often mandated by the state for drivers who have received traffic violations or have been involved in accidents. They focus on improving driving habits and preventing future incidents.

Impact of Driver Safety Programs on Car Insurance Premiums

Participating in driver safety programs can have a positive impact on your car insurance premiums in Minnesota. Insurance companies often offer discounts to drivers who complete approved driver safety courses.

Discount Amount: The discount amount can vary depending on the insurance company, the type of course completed, and other factors such as the driver’s age and driving history.

Resources for Finding Driver Safety Programs in Minnesota

Finding driver safety programs in Minnesota is relatively straightforward. Several resources can assist you in locating the right course for your needs:

- Minnesota Department of Public Safety (DPS): The DPS website provides information on driver safety programs, including approved courses and resources for finding providers.

- Insurance Companies: Contact your insurance company to inquire about available discounts for completing driver safety courses and for recommended providers.

- AAA (American Automobile Association): AAA offers driver safety courses in Minnesota, both online and in-person.

- Local Community Colleges and Adult Education Centers: Many community colleges and adult education centers in Minnesota offer driver safety courses.

Car Insurance for Specific Situations in Minnesota

In Minnesota, obtaining car insurance is mandatory, but specific situations can influence the type of coverage required and the cost of premiums. This section delves into the nuances of car insurance for individuals facing unique circumstances, such as a DUI conviction, high-risk driving history, or specific needs of young drivers.

Car Insurance for Drivers with a DUI Conviction in Minnesota

A DUI conviction in Minnesota significantly impacts car insurance premiums. Drivers convicted of DUI face higher premiums due to the increased risk they pose to insurers. The impact of a DUI conviction on insurance premiums varies depending on factors such as the severity of the offense, the driver’s driving history, and the insurer’s specific policies.

Car Insurance for High-Risk Drivers in Minnesota

Drivers with a history of accidents, traffic violations, or other risk factors are considered high-risk by insurers. Obtaining car insurance for high-risk drivers in Minnesota can be challenging, as insurers may be reluctant to offer coverage or may charge significantly higher premiums.

High-risk drivers in Minnesota can consider the following options to secure car insurance:

- Specialized Insurers: Several insurance companies cater specifically to high-risk drivers. These insurers may offer coverage even with a poor driving history, but premiums are typically higher.

- State-Funded Programs: Minnesota offers a few state-funded programs that provide car insurance for drivers who cannot obtain coverage through traditional insurers.

- Improving Driving Record: High-risk drivers can improve their chances of obtaining affordable car insurance by taking defensive driving courses, maintaining a clean driving record, and demonstrating responsible driving habits.

Obtaining SR-22 Insurance in Minnesota

An SR-22 is a form filed with the Minnesota Department of Motor Vehicles (DMV) by an insurance company to prove financial responsibility. It is typically required for drivers who have been convicted of certain offenses, such as DUI, reckless driving, or driving without insurance.

To obtain SR-22 insurance in Minnesota, drivers must:

- Contact an Insurance Company: Drivers need to contact an insurance company that offers SR-22 coverage. Not all insurance companies provide SR-22 insurance.

- Meet Eligibility Requirements: Insurance companies have specific eligibility requirements for SR-22 insurance, which may vary depending on the driver’s driving history and the severity of the offense.

- Pay Higher Premiums: SR-22 insurance typically comes with higher premiums compared to standard car insurance policies.

- Maintain Coverage: Drivers must maintain SR-22 insurance for the specified period, which is usually determined by the court or the DMV.

Car Insurance for Young Drivers in Minnesota

Young drivers, especially those under the age of 25, are considered high-risk by insurers due to their lack of experience and higher accident rates.

To obtain car insurance for young drivers in Minnesota, consider the following:

- Good Student Discounts: Many insurance companies offer discounts to young drivers who maintain good grades in school.

- Defensive Driving Courses: Completing a defensive driving course can demonstrate responsible driving habits and may lead to lower premiums.

- Adding a Young Driver to an Existing Policy: Adding a young driver to an existing policy may result in lower premiums compared to purchasing a separate policy.

- Comparing Quotes: Obtaining quotes from multiple insurance companies can help find the most affordable option.

Resources for Minnesota Car Insurance Information

Navigating the world of car insurance in Minnesota can feel overwhelming, but there are many resources available to help you make informed decisions. Understanding your options and rights is crucial to securing the best coverage at the most affordable price.

Minnesota Department of Commerce

The Minnesota Department of Commerce is the primary regulatory body for car insurance in the state. They are responsible for ensuring that insurance companies operate fairly and transparently. The department offers a wealth of information on car insurance, including consumer guides, FAQs, and complaint procedures.

- Website: https://mn.gov/commerce/

- Phone: (651) 296-2488

- Email: [email protected]

Free Car Insurance Quotes

Several websites offer free car insurance quotes, allowing you to compare prices from different insurers without providing personal information. This can be a valuable tool for finding the best deal on your car insurance.

- QuoteWizard: https://www.quotewizard.com/

- Insurify: https://www.insurify.com/

- The Zebra: https://www.thezebra.com/

Independent Insurance Agents

Independent insurance agents in Minnesota can provide valuable guidance and assistance in finding the right car insurance policy for your needs. They represent multiple insurance companies, allowing them to offer a wider range of options and potentially better rates.

- Benefits: Independent agents can provide personalized advice, negotiate on your behalf, and help you navigate complex insurance policies.

- Finding an Agent: You can search for independent insurance agents in your area through online directories or by asking for referrals from friends and family.

Understanding Car Insurance Coverage Options in Minnesota

Minnesota requires drivers to carry liability insurance, which protects others from financial losses in the event of an accident caused by you. However, other coverage options provide additional protection for you and your vehicle.

Liability Coverage

Liability coverage is mandatory in Minnesota and protects you financially if you cause an accident that injures another person or damages their property. It covers the following:

- Bodily injury liability: This covers medical expenses, lost wages, and pain and suffering for the other driver and passengers involved in an accident you caused.

- Property damage liability: This covers the cost of repairs or replacement of the other driver’s vehicle or property damaged in an accident you caused.

The minimum liability limits required in Minnesota are:

- $30,000 per person for bodily injury

- $60,000 per accident for bodily injury

- $10,000 per accident for property damage

However, these limits may not be sufficient to cover all expenses in a serious accident. You can purchase higher limits to provide greater financial protection.

Liability coverage only protects others, not you or your vehicle.

Collision Insurance

Collision insurance covers damage to your vehicle caused by a collision with another vehicle or object, regardless of who is at fault. This coverage is optional but can be valuable if you want to ensure that your vehicle is repaired or replaced after an accident.

- Deductible: You will have to pay a deductible, which is a fixed amount, before your insurance company covers the remaining repair costs. The higher the deductible, the lower your premium.

- Coverage Limits: Collision coverage typically covers the actual cash value (ACV) of your vehicle, which is its market value before the accident. You may have the option to purchase replacement cost coverage, which covers the cost of a new vehicle if yours is totaled.

Comprehensive Insurance

Comprehensive insurance covers damage to your vehicle from events other than collisions, such as theft, vandalism, fire, hail, and natural disasters. It is optional but can be valuable if you want to protect your vehicle from unexpected events.

- Deductible: Similar to collision coverage, you will have to pay a deductible before your insurance company covers the remaining repair costs.

- Coverage Limits: Comprehensive coverage typically covers the actual cash value (ACV) of your vehicle. You may have the option to purchase replacement cost coverage, which covers the cost of a new vehicle if yours is totaled.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist (UM/UIM) coverage protects you and your passengers from financial losses if you are injured in an accident caused by a driver who is uninsured or underinsured. It covers medical expenses, lost wages, and pain and suffering.

- Uninsured Motorist Coverage: This covers you if the other driver is uninsured.

- Underinsured Motorist Coverage: This covers you if the other driver’s liability coverage is insufficient to cover your losses.

UM/UIM coverage is optional in Minnesota but is highly recommended. You can choose to purchase coverage limits that are equal to or greater than your liability coverage limits.

Tips for Saving on Car Insurance in Minnesota

Car insurance is a necessity for all drivers in Minnesota, but it can be a significant expense. Fortunately, there are several ways to reduce your premiums and save money. By taking advantage of discounts, shopping around for the best rates, and driving safely, you can lower your insurance costs and keep more money in your pocket.

Bundling Car Insurance with Other Policies

Bundling your car insurance with other insurance policies, such as homeowners or renters insurance, can lead to significant savings. Insurance companies often offer discounts to customers who bundle multiple policies, as it reduces their administrative costs and increases their customer loyalty. For instance, bundling your car insurance with your homeowners insurance could result in a discount of up to 15% or more.

Discounts for Good Drivers

Many insurance companies offer discounts for good drivers who have a clean driving record. These discounts can be substantial, particularly for drivers with no accidents or traffic violations. Some common discounts include:

- Safe Driver Discount: This discount is typically awarded to drivers who have not been involved in any accidents or received any traffic citations within a specific timeframe, usually three to five years.

- Defensive Driving Course Discount: Completing a defensive driving course can demonstrate your commitment to safe driving and earn you a discount. These courses teach safe driving techniques and traffic laws, which can help you avoid accidents and lower your insurance premiums.

- Good Student Discount: Students who maintain good grades can often qualify for a discount on their car insurance. This discount acknowledges the positive correlation between academic achievement and responsible driving behavior.

Maintaining a Good Credit Score

In Minnesota, as in many other states, insurance companies can use your credit score to determine your car insurance premiums. A good credit score can lead to lower premiums, while a poor credit score can result in higher premiums. This is because insurance companies view a good credit score as an indicator of financial responsibility, which can translate to responsible driving behavior.

Important Note: While credit score can be a factor, it is not the only factor considered. Your driving record, vehicle type, and other factors also play a role in determining your insurance premiums.

Car Insurance and Minnesota’s Laws

The Minnesota Legislature plays a crucial role in shaping the state’s car insurance landscape, enacting laws that govern coverage requirements, pricing, and consumer protections. These laws are constantly evolving to address changing needs and circumstances.

Recent Changes to Car Insurance Laws in Minnesota

In recent years, Minnesota has witnessed several significant changes to its car insurance laws, reflecting a commitment to ensuring affordability, fairness, and consumer protection.

- No-Fault Insurance Reforms (2021): The 2021 legislative session saw significant changes to Minnesota’s no-fault system, aiming to reduce costs and streamline claims. These reforms included:

- Limits on Medical Expense Coverage: The maximum amount of medical expense coverage available under the no-fault system was reduced from $100,000 to $40,000, with a provision for additional coverage available in certain cases.

- Changes to the “Threshold” for Filing a Personal Injury Lawsuit: The threshold for filing a lawsuit for pain and suffering was raised, making it more difficult to sue for these damages.

- New Requirements for Accident Reporting: New reporting requirements were established for accidents involving property damage, with the goal of streamlining the claims process.

- Rate Regulation: The Minnesota Legislature has taken steps to regulate insurance rates, aiming to ensure fairness and transparency. These regulations involve:

- Rate Filing Requirements: Insurance companies are required to file their rates with the Minnesota Department of Commerce, allowing for review and potential adjustments.

- Rate Approval Process: The Department of Commerce has the authority to review and approve or deny rate filings, ensuring that rates are justified and fair.

- Rate Caps: In some cases, the Legislature has imposed rate caps, limiting the extent to which insurance companies can increase rates.

Pending Legislation Related to Car Insurance in Minnesota

The Minnesota Legislature is currently considering several proposals that could impact car insurance laws in the state. These proposals include:

- Expanding Access to Telematics-Based Discounts: Legislation is being considered to expand the use of telematics, which involves using devices to track driving behavior, to provide discounts to safe drivers.

- Increasing Transparency in Rate Setting: Some proposals aim to increase transparency in the way insurance rates are set, providing consumers with more information about how their rates are determined.

- Addressing the Issue of Uninsured Motorists: Legislation is being considered to address the issue of uninsured motorists, which can pose significant financial risks to insured drivers.

Resources for Staying Updated on Car Insurance Laws in Minnesota

Staying informed about changes to car insurance laws is essential for drivers in Minnesota. Several resources can help you stay up-to-date:

- Minnesota Department of Commerce: The Minnesota Department of Commerce is responsible for regulating the insurance industry in the state. Their website provides information about car insurance laws, regulations, and consumer protections.

- Minnesota Legislature: The Minnesota Legislature’s website provides access to legislative bills, committee hearings, and other information related to car insurance laws.

- Consumer Protection Organizations: Consumer protection organizations, such as the Minnesota Office of the Attorney General and the Consumer Federation of America, often provide information and resources on car insurance laws.

Final Conclusion

Navigating Minnesota’s car insurance landscape requires a blend of knowledge, awareness, and proactive action. By understanding the state’s unique regulations, utilizing available resources, and implementing cost-saving strategies, drivers can navigate the process effectively. This guide serves as a starting point for informed decision-making, empowering you to secure the right coverage at a price that fits your budget.