Texas, known for its sprawling plains and vibrant cities, also boasts a vast coastline susceptible to the wrath of hurricanes. For residents in these vulnerable areas, the Texas Windstorm Insurance Association (TWIA) serves as a crucial lifeline, providing a safety net against the financial devastation that can accompany these natural disasters. This organization, a state-backed insurer of last resort, plays a critical role in the Texas insurance market, ensuring that coastal communities have access to affordable and reliable windstorm coverage.

This article delves into the intricacies of TWIA, exploring its history, operations, and the vital services it provides. We’ll examine the types of coverage offered, the claims process, and the financial stability of the association. We’ll also discuss the challenges faced by TWIA, including the impact of climate change and the need for ongoing reform. By shedding light on this essential entity, we aim to empower Texas residents with a deeper understanding of their insurance options and the critical role TWIA plays in protecting coastal communities.

Texas Windstorm Insurance Association

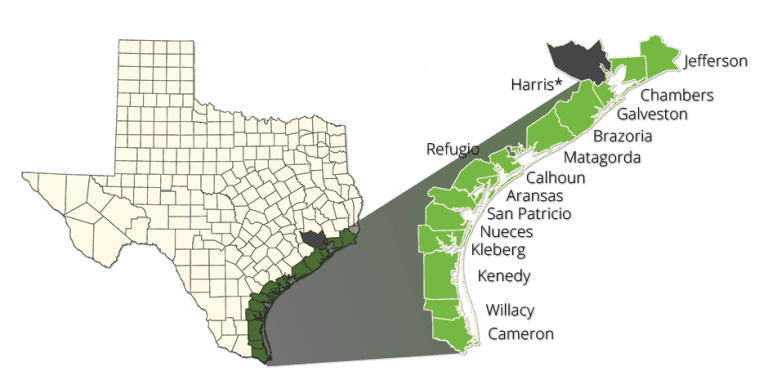

The Texas Windstorm Insurance Association (TWIA) is a state-backed insurance provider that offers windstorm and hail coverage to property owners in 14 coastal counties in Texas. Created in 1971, TWIA serves as a safety net for those who may struggle to find coverage in the private market due to the high risk associated with hurricanes and other severe weather events.

TWIA plays a crucial role in the Texas insurance market, particularly for coastal areas. It provides a vital source of insurance coverage for homeowners and businesses who might otherwise be left uninsured or underinsured. TWIA’s presence helps to stabilize the insurance market in these high-risk areas by reducing the burden on private insurers and encouraging competition.

TWIA’s Operations and Structure

TWIA is a non-profit, state-created entity that operates as a residual market insurer. This means that it provides coverage to those who cannot obtain it from private insurers. It is governed by a board of directors appointed by the Texas Commissioner of Insurance, ensuring oversight and accountability.

- Funding: TWIA is funded through policyholder premiums, assessments on private insurers, and state appropriations. The premiums collected from policyholders are used to cover claims and administrative expenses. When losses exceed premiums collected, the state can provide financial support to TWIA through assessments on private insurers or direct appropriations.

- Coverage: TWIA offers coverage for windstorm and hail damage to residential, commercial, and industrial properties. The coverage limits and deductibles vary depending on the property’s location, type, and value.

- Claims Process: TWIA has a dedicated claims department that handles claims from policyholders. The claims process is similar to that of private insurers, involving inspections, assessments, and payments for covered damages. TWIA’s claims process is designed to be fair and efficient, with a focus on resolving claims promptly.

TWIA is a vital component of the Texas insurance market, providing coverage to those who might otherwise be left vulnerable to the financial devastation of a major windstorm. Its role in ensuring access to insurance and stabilizing the market is essential for the well-being of coastal communities in Texas.

TWIA Coverage and Policies

The Texas Windstorm Insurance Association (TWIA) is a state-backed insurer that provides windstorm and hail coverage to property owners in designated coastal areas of Texas. TWIA offers a variety of coverage options, including property, liability, and flood insurance. This section will delve into the details of TWIA coverage and policies.

Eligibility Criteria for TWIA Insurance

To be eligible for TWIA insurance, property owners must meet specific criteria. These criteria include:

- The property must be located within a designated coastal area of Texas, as defined by TWIA.

- The property must be a primary residence or a rental property.

- The property must meet certain construction standards, as specified by TWIA.

- The property must be insured for at least 80% of its replacement cost value.

Premium Calculation Process and Factors Influencing Premiums

TWIA premiums are calculated based on a variety of factors, including:

- The property’s location and proximity to the coast.

- The property’s construction type and age.

- The property’s replacement cost value.

- The property’s deductible amount.

- The property’s history of windstorm claims.

Comparison of TWIA Policies with Private Insurance Policies for Windstorm Coverage

TWIA policies are often compared to private insurance policies for windstorm coverage. While both types of policies provide coverage for windstorm damage, there are some key differences:

- Availability: TWIA policies are available to property owners in designated coastal areas of Texas who are unable to obtain coverage from private insurers. Private insurance policies are generally available to property owners in all areas of Texas, but may be more expensive or difficult to obtain in coastal areas.

- Coverage: TWIA policies typically provide coverage for windstorm damage, including damage caused by hail, tornadoes, and hurricanes. Private insurance policies may also provide coverage for other perils, such as fire, theft, and vandalism. However, the specific coverage provided by a private insurance policy may vary depending on the policy and the insurer.

- Premiums: TWIA premiums are generally lower than private insurance premiums for windstorm coverage. However, TWIA premiums may be subject to annual increases based on the association’s financial performance. Private insurance premiums may be more expensive, but may be less likely to increase significantly from year to year.

- Deductibles: TWIA policies typically have higher deductibles than private insurance policies. The deductible amount is the amount of money that the policyholder must pay out of pocket before the insurance company begins to pay for damages. A higher deductible can result in lower premiums, but it also means that the policyholder will be responsible for a larger portion of the cost of repairs in the event of a windstorm.

Claims Process and Procedures

The Texas Windstorm Insurance Association (TWIA) has a straightforward claims process designed to ensure policyholders receive timely and fair compensation for covered losses. This process involves several steps, from initial reporting to final settlement.

Documentation Required for a Claim

Policyholders are required to provide certain documentation to support their claims. This documentation helps TWIA verify the extent of the damage and ensure the claim is eligible for coverage.

- Proof of Loss: This document Artikels the details of the damage, including the date of the storm, the type of damage, and the estimated cost of repairs. Policyholders can typically obtain this document from a qualified contractor or adjuster.

- Photographs or Videos: Visual documentation of the damage is essential for supporting the claim. These images should clearly depict the extent of the damage and provide context for the loss.

- Receipts and Invoices: Supporting documentation for any repairs or replacements made is necessary to demonstrate the cost of the damage. These receipts should be detailed and include the date of purchase, the name of the vendor, and the specific items purchased.

- Policy Information: Policyholders should provide their policy number and other relevant policy details to ensure TWIA can access the correct coverage information.

Claim Settlement Process and Timelines

Once TWIA receives a complete claim, they begin the assessment and settlement process.

- Initial Review: TWIA reviews the documentation provided to determine if the claim is eligible for coverage under the policy. This process typically takes a few days.

- Inspection: If the claim is eligible, TWIA will schedule an inspection of the damaged property to assess the extent of the damage and verify the cost estimates provided. The inspection process can take a few weeks depending on the complexity of the damage and the availability of inspectors.

- Negotiation: After the inspection, TWIA will negotiate the settlement amount with the policyholder. This process may involve several rounds of communication to reach an agreement. Negotiations can take several weeks or even months depending on the complexity of the claim and the willingness of both parties to compromise.

- Payment: Once a settlement is reached, TWIA will issue payment to the policyholder. The payment may be made directly to the policyholder or to the contractor or vendor performing the repairs.

Common Claim Disputes and Resolution

While TWIA strives to resolve claims fairly and efficiently, disputes can arise.

- Coverage Disputes: Disputes may arise when the policyholder believes their claim is covered, but TWIA determines it is not. These disputes are often resolved through negotiation, mediation, or arbitration, depending on the specific circumstances and the terms of the policy.

- Valuation Disputes: Disputes can also arise over the value of the damage. This can occur when the policyholder believes the estimated cost of repairs is too low or when TWIA believes the estimate is too high. These disputes are typically resolved through a re-inspection or through negotiation based on independent appraisals.

- Payment Disputes: Disputes may arise when the policyholder believes the payment amount is too low or when TWIA believes the payment amount is too high. These disputes can be resolved through negotiation, mediation, or arbitration, depending on the specific circumstances and the terms of the policy.

TWIA Financial Stability and Regulation

The Texas Windstorm Insurance Association (TWIA) plays a crucial role in providing windstorm coverage to coastal residents of Texas, particularly in areas where private insurers are reluctant to offer policies. Ensuring the financial stability and regulatory oversight of TWIA is essential to guarantee its ability to meet policyholder claims and maintain its role in the state’s insurance market.

TWIA’s Financial Health and Claim-Paying Ability

TWIA’s financial health is paramount to its ability to pay claims. The association maintains a variety of mechanisms to ensure its solvency, including:

- Capitalization: TWIA’s capital structure is designed to absorb potential losses from catastrophic events. The association maintains a surplus, a reserve fund that acts as a financial cushion to cover unexpected claims.

- Reinsurance: TWIA purchases reinsurance to transfer a portion of its risk to other insurance companies. This helps limit the association’s exposure to large claims and ensures it can continue operating even after a major event.

- Assessments: In the event of a significant catastrophe, TWIA can assess its policyholders to supplement its resources. These assessments are levied proportionally based on policyholders’ coverage amounts.

- State Support: The Texas Legislature has established a mechanism for state support in the event of a catastrophic event that overwhelms TWIA’s financial capacity. This provides an additional layer of security for policyholders.

TWIA’s financial performance is regularly monitored by its board of directors and the Texas Department of Insurance (TDI). The TDI conducts audits and reviews to ensure TWIA’s compliance with regulations and its ability to meet its financial obligations.

Regulatory Framework Governing TWIA

TWIA operates under a specific regulatory framework established by the Texas Legislature and overseen by the TDI. Key aspects of this framework include:

- Statutory Authority: TWIA’s creation and operations are governed by the Texas Windstorm Insurance Act, which Artikels the association’s powers, responsibilities, and regulatory requirements.

- Rate Setting: The TDI regulates TWIA’s rates to ensure they are fair, adequate, and not excessive. This involves a rigorous process of reviewing and approving rate filings submitted by TWIA.

- Financial Oversight: The TDI monitors TWIA’s financial condition, including its capital adequacy, surplus levels, and reinsurance arrangements. The department conducts regular audits and reviews to ensure compliance with financial regulations.

- Consumer Protection: The TDI is responsible for protecting TWIA policyholders from unfair or deceptive practices. This includes addressing complaints and resolving disputes between policyholders and the association.

Impact of Catastrophic Events on TWIA’s Financial Stability

Catastrophic events, such as hurricanes, pose significant challenges to TWIA’s financial stability. These events can generate massive claims, potentially exceeding the association’s existing resources. However, TWIA’s financial structure and regulatory oversight are designed to mitigate these risks.

- Reinsurance: TWIA’s reinsurance program helps transfer a portion of its risk to other insurance companies, limiting its exposure to catastrophic losses.

- Assessments: TWIA can assess its policyholders to supplement its resources after a major event, ensuring its ability to pay claims.

- State Support: The Texas Legislature has provided a mechanism for state support in the event of a catastrophic event that overwhelms TWIA’s financial capacity. This provides an additional layer of security for policyholders.

TWIA’s ability to recover from catastrophic events depends on the severity of the event, the availability of reinsurance, and the effectiveness of its assessments and state support mechanisms.

Key Stakeholders in TWIA’s Governance and Oversight

Several key stakeholders are involved in TWIA’s governance and oversight, ensuring its financial stability and regulatory compliance.

- Texas Windstorm Insurance Association (TWIA): The association itself is responsible for providing windstorm coverage, managing its finances, and complying with regulatory requirements.

- Texas Department of Insurance (TDI): The TDI is the primary regulator of TWIA, responsible for setting rates, monitoring financial condition, and enforcing compliance with regulations.

- TWIA Board of Directors: The board oversees the association’s operations, including setting policy, approving budgets, and appointing management.

- Texas Legislature: The legislature sets the regulatory framework for TWIA, including the Texas Windstorm Insurance Act, which Artikels the association’s powers and responsibilities.

- Policyholders: TWIA’s policyholders are essential stakeholders, benefiting from the association’s coverage and participating in its governance through the election of board members.

Impact of TWIA on Texas Coastal Communities

The Texas Windstorm Insurance Association (TWIA) plays a crucial role in providing affordable insurance to residents of Texas coastal communities. Its impact on the availability and cost of insurance in these areas is significant, and its relationship with the Texas Department of Insurance (TDI) is vital to its operations. However, TWIA faces challenges in providing coverage in high-risk areas, particularly due to the inherent risk associated with hurricanes and the potential for catastrophic losses.

Availability and Cost of Insurance

TWIA’s presence in coastal communities significantly impacts the availability and cost of insurance.

- Increased Availability: TWIA acts as a safety net for coastal residents, providing insurance when private insurers are unwilling or unable to do so. This is particularly important in high-risk areas where the likelihood of hurricane damage is high.

- Reduced Premiums: TWIA’s rates are generally lower than those offered by private insurers, making insurance more affordable for coastal residents. This affordability is essential for maintaining the economic viability of coastal communities and encouraging continued investment in these areas.

Relationship with the Texas Department of Insurance

The Texas Department of Insurance (TDI) plays a regulatory role in overseeing TWIA’s operations.

- Rate Setting: TDI reviews and approves TWIA’s rates to ensure they are fair and adequate. This process involves a thorough analysis of risk factors, historical claims data, and market conditions.

- Financial Oversight: TDI monitors TWIA’s financial stability to ensure it can meet its obligations to policyholders. This includes assessing the adequacy of TWIA’s reserves and its ability to withstand significant hurricane losses.

- Consumer Protection: TDI works to protect consumers by ensuring that TWIA complies with all applicable insurance laws and regulations. This includes addressing consumer complaints and investigating potential fraud or misconduct.

Challenges Faced by TWIA

TWIA faces several challenges in providing coverage in high-risk areas.

- Catastrophic Risk: Coastal communities are particularly vulnerable to hurricanes, which can result in significant losses. TWIA must carefully manage its exposure to catastrophic risk to ensure its financial stability.

- Reinsurance Costs: TWIA relies on reinsurance to protect itself from large losses. However, reinsurance costs have been increasing in recent years due to the growing frequency and intensity of hurricanes.

- Funding and Capitalization: TWIA’s financial stability depends on its ability to raise sufficient capital to cover potential losses. This can be challenging in the aftermath of a major hurricane, when demand for insurance increases significantly.

Future of TWIA

The Texas Windstorm Insurance Association (TWIA) faces a complex and evolving landscape, influenced by a confluence of factors, including climate change, regulatory shifts, and the evolving needs of Texas coastal communities. Understanding these dynamics is crucial for assessing the future of TWIA and its ability to fulfill its mission of providing affordable and accessible windstorm insurance in a changing environment.

Climate Change Impact on TWIA Operations

Climate change presents significant challenges for TWIA and its operations. Rising sea levels, increased storm intensity, and more frequent severe weather events pose a direct threat to coastal communities and increase the likelihood of catastrophic losses. These factors can lead to:

* Increased Claims Costs: More frequent and intense storms translate into higher claim payouts for TWIA, potentially straining its financial resources.

* Capacity Constraints: The increasing risk associated with coastal properties may make it challenging for TWIA to secure reinsurance coverage, potentially limiting its ability to issue new policies or renew existing ones.

* Higher Premiums: To mitigate the financial risk associated with climate change, TWIA may need to raise premiums, potentially making coverage less affordable for some policyholders.

These challenges highlight the need for TWIA to adapt its operations to address the realities of climate change.

Challenges and Opportunities for TWIA

TWIA faces a number of challenges in the future, but also has opportunities to adapt and thrive:

* Financial Stability: Maintaining financial stability is paramount for TWIA. Climate change, coupled with potential economic downturns, can significantly impact its financial health.

* Regulatory Landscape: TWIA operates within a complex regulatory environment, subject to changes in state and federal laws. Adapting to these changes is crucial for its long-term success.

* Competition: The private insurance market is evolving, with new players entering the market and existing insurers expanding their offerings. TWIA must remain competitive to attract and retain policyholders.

Despite these challenges, TWIA has opportunities to leverage its unique position as a public entity and its expertise in the windstorm insurance market.

Potential Changes to TWIA’s Coverage and Policies

To address the evolving risks and needs of its policyholders, TWIA may consider:

* Adjusting Coverage Limits: Adjusting coverage limits for windstorm damage based on projected increases in storm intensity and frequency.

* Implementing Mitigation Measures: Encouraging and incentivizing policyholders to implement mitigation measures, such as strengthening their homes, to reduce potential losses.

* Expanding Coverage Options: Exploring new coverage options, such as flood insurance, to meet the comprehensive needs of coastal communities.

These potential changes could enhance TWIA’s ability to provide adequate coverage and promote the long-term sustainability of its operations.

Key Trends and Factors Influencing TWIA’s Future

Several key trends and factors will shape the future of TWIA:

* Technological Advancements: Advancements in technology, such as artificial intelligence and predictive modeling, can improve risk assessment, claims processing, and fraud detection.

* Public Policy: Policy decisions at the state and federal levels, particularly regarding climate change mitigation and adaptation, will have a direct impact on TWIA’s operations.

* Consumer Behavior: Changes in consumer preferences and risk tolerance, driven by climate change awareness and evolving economic conditions, will influence demand for windstorm insurance.

TWIA’s ability to adapt to these trends and factors will be critical for its continued success in providing essential windstorm insurance to Texas coastal communities.

TWIA vs. Private Insurance

The Texas Windstorm Insurance Association (TWIA) and private insurance companies offer coverage for windstorm damage in coastal areas of Texas. While both options provide financial protection, they differ significantly in terms of coverage, cost, and accessibility. Understanding these differences is crucial for homeowners in coastal regions to make informed decisions about their insurance needs.

Benefits and Drawbacks of TWIA and Private Insurance

TWIA and private insurance companies offer distinct advantages and disadvantages, which influence the choice of coverage for homeowners.

- TWIA:

- Benefits:

- Guaranteed coverage: TWIA provides coverage to all eligible homeowners in its designated coastal areas, regardless of their risk profile or prior claims history.

- Lower premiums: TWIA premiums are generally lower than private insurance premiums, especially for properties considered high-risk by private insurers.

- Drawbacks:

- Limited coverage: TWIA’s coverage may be less comprehensive than private insurance policies, with lower coverage limits and stricter deductibles.

- Potential for higher deductibles: TWIA deductibles can be significantly higher than private insurance deductibles, especially for properties in high-risk areas.

- Limited availability of optional coverages: TWIA may not offer certain optional coverages available through private insurers, such as flood insurance or replacement cost coverage.

- Benefits:

- Private Insurance:

- Benefits:

- More comprehensive coverage: Private insurers typically offer more comprehensive coverage options, including higher coverage limits and lower deductibles.

- Wider range of optional coverages: Private insurers offer a wider range of optional coverages, such as flood insurance, replacement cost coverage, and personal property coverage.

- More flexible payment options: Private insurers often offer more flexible payment options, such as monthly installments or discounts for bundling insurance policies.

- Drawbacks:

- Higher premiums: Private insurance premiums can be significantly higher than TWIA premiums, especially for high-risk properties.

- Potential for coverage denial: Private insurers may deny coverage to homeowners with a history of claims or who live in high-risk areas.

- Limited availability in high-risk areas: Private insurers may not offer coverage in certain high-risk areas where the risk of windstorm damage is considered too high.

Factors Influencing the Decision to Choose TWIA or Private Insurance

The choice between TWIA and private insurance depends on several factors, including:

- Property location: Properties located in high-risk areas with a history of windstorm damage may find it challenging to obtain private insurance or face significantly higher premiums. In such cases, TWIA may be the only available option.

- Property value: Homeowners with high-value properties may benefit from private insurance due to its higher coverage limits and comprehensive coverage options. However, they should be prepared for higher premiums.

- Risk tolerance: Homeowners with a higher risk tolerance may be comfortable with the lower premiums and guaranteed coverage offered by TWIA, even if it means accepting lower coverage limits and higher deductibles.

- Financial resources: Homeowners with limited financial resources may find TWIA’s lower premiums more manageable, even if it means accepting less comprehensive coverage.

- Insurance needs: Homeowners with specific insurance needs, such as flood insurance or replacement cost coverage, may find private insurers more suitable due to their wider range of optional coverages.

Situations Where TWIA Insurance May Be a Better Option Than Private Insurance

TWIA insurance may be a better option than private insurance in the following situations:

- High-risk properties: Homeowners with properties located in high-risk areas with a history of windstorm damage may find it difficult to obtain private insurance or face significantly higher premiums. TWIA provides guaranteed coverage to all eligible homeowners in its designated coastal areas, regardless of their risk profile or prior claims history.

- Limited financial resources: Homeowners with limited financial resources may find TWIA’s lower premiums more manageable, even if it means accepting less comprehensive coverage.

- Unwillingness to pay high premiums: Homeowners who are unwilling to pay the high premiums demanded by private insurers for high-risk properties may find TWIA a more affordable option.

Role of the Texas Windstorm Insurance Association in the Overall Insurance Market

TWIA plays a crucial role in the Texas insurance market by providing a safety net for homeowners in coastal areas who may not be able to obtain private insurance. It ensures that all eligible homeowners have access to windstorm insurance, regardless of their risk profile or prior claims history. By providing a competitive alternative to private insurance, TWIA helps stabilize the market and prevent a surge in insurance costs for homeowners in high-risk areas.

Consumer Information and Resources

Navigating the complex world of insurance can be daunting, especially when dealing with a specialized entity like the Texas Windstorm Insurance Association (TWIA). Understanding your rights, accessing available resources, and navigating the claims process are crucial for policyholders. This section provides a comprehensive guide for consumers seeking information about TWIA insurance, ensuring a smoother and more informed experience.

Obtaining Quotes and Comparing Coverage

Before purchasing any insurance policy, it is essential to compare quotes from multiple providers to find the best value for your needs. TWIA offers a variety of coverage options, and understanding these options is crucial for making informed decisions. Here are some steps to help you obtain quotes and compare coverage:

- Visit the TWIA website: TWIA provides a user-friendly online platform where you can obtain quotes, compare coverage options, and learn more about their policies. The website includes detailed information on policy types, deductibles, and coverage limits, allowing you to make informed comparisons.

- Contact a TWIA-approved agent: TWIA works with a network of approved agents who can assist you in obtaining quotes, understanding policy details, and selecting the right coverage for your needs. These agents are knowledgeable about TWIA policies and can provide personalized guidance.

- Compare quotes from private insurers: While TWIA is the insurer of last resort in coastal areas, private insurers may also offer windstorm coverage. Comparing quotes from both TWIA and private insurers can help you find the most competitive rates and coverage options.

Filing Claims and Resolving Disputes

In the event of a windstorm, filing a claim promptly is essential. TWIA has a streamlined claims process designed to ensure efficient and fair handling of claims. Here’s how to navigate the claims process:

- Report the claim: Contact TWIA immediately after a windstorm to report your claim. You can report the claim online, by phone, or through a TWIA-approved agent. Provide all necessary information, including details about the damage and the date and time of the windstorm.

- Document the damage: Take detailed photographs and videos of the damage to your property. This documentation will be crucial for supporting your claim. Keep all receipts and invoices related to repairs or temporary housing expenses.

- Work with a TWIA-approved adjuster: TWIA will assign a claims adjuster to assess the damage and determine the extent of coverage. Cooperate fully with the adjuster and provide all requested information and documentation. If you disagree with the adjuster’s assessment, you have the right to appeal the decision.

- Seek mediation: If you are unable to resolve a dispute with TWIA through the appeals process, you can seek mediation through the Texas Department of Insurance. Mediation is a neutral process where a third party facilitates communication and helps both parties reach a mutually agreeable solution.

Understanding Policy Terms and Conditions

TWIA policies, like any insurance policy, contain specific terms and conditions that define the scope of coverage and the responsibilities of both the insurer and the insured. It is crucial to understand these terms and conditions to avoid misunderstandings and ensure that you are adequately protected. Here are some key aspects to understand:

- Deductible: The deductible is the amount you are responsible for paying out of pocket before TWIA covers the remaining costs. Higher deductibles generally result in lower premiums, while lower deductibles lead to higher premiums. Choose a deductible that fits your financial situation and risk tolerance.

- Coverage limits: TWIA policies have specific coverage limits, which define the maximum amount the insurer will pay for different types of damage. Ensure that the coverage limits are sufficient to cover the potential costs of rebuilding or repairing your property.

- Exclusions: TWIA policies exclude certain types of damage, such as damage caused by floods or earthquakes. Understanding these exclusions is crucial to ensure that you have appropriate coverage for all potential risks.

Tips for Navigating the Insurance Process with TWIA

Navigating the insurance process can be complex, but following these tips can help you navigate the process with TWIA more effectively:

- Read your policy carefully: Take the time to thoroughly read your TWIA policy and understand the terms and conditions. If you have any questions, do not hesitate to contact TWIA or your agent for clarification.

- Keep accurate records: Maintain detailed records of all communications with TWIA, including dates, times, and the content of conversations. This documentation can be helpful in resolving any disputes.

- Be prepared for the claims process: Familiarize yourself with TWIA’s claims process and gather all necessary documentation, such as photographs, receipts, and invoices, before filing a claim. This will help streamline the process and avoid delays.

- Consider seeking professional assistance: If you find the insurance process overwhelming or have complex questions, consider seeking professional assistance from an insurance attorney or a public adjuster. These professionals can provide expert guidance and advocate for your interests.

Case Studies

TWIA’s performance during catastrophic events and its impact on coastal communities provide valuable insights into its effectiveness. Examining real-world examples allows for a comprehensive understanding of TWIA’s strengths, weaknesses, and the challenges it faces in fulfilling its mission.

Hurricane Harvey

Hurricane Harvey, which made landfall in August 2017, was one of the most devastating hurricanes in Texas history. TWIA processed over 100,000 claims, totaling over $1.5 billion in payouts. While the volume of claims presented significant challenges, TWIA successfully processed the majority of claims within a reasonable timeframe.

“The TWIA response to Hurricane Harvey was a testament to their commitment to policyholders. Despite the overwhelming number of claims, they managed to provide timely assistance and financial support to those who needed it most.” – Texas Coastal Insurance Advocate

The experience with Harvey highlighted the importance of TWIA’s role in providing financial stability to coastal communities.

Hurricane Ike

Hurricane Ike, which made landfall in September 2008, caused significant damage to the Texas Gulf Coast. TWIA processed over 60,000 claims, totaling over $1 billion in payouts. The storm’s impact on the coastal communities was significant, and TWIA played a crucial role in helping these communities recover.

“TWIA’s response to Hurricane Ike was a model of efficiency and responsiveness. They worked tirelessly to ensure that policyholders received the compensation they needed to rebuild their lives and businesses.” – Texas Insurance Commissioner

Impact on Coastal Communities

The impact of TWIA on coastal communities is multifaceted. TWIA’s existence provides a safety net for homeowners and businesses in coastal areas, offering them access to windstorm insurance, even when private insurers are reluctant to provide coverage. This access to insurance allows for continued development and economic growth in coastal communities.

However, TWIA’s financial stability can be affected by catastrophic events, which can lead to increased premiums for policyholders. This can be a challenge for coastal communities, as higher premiums can make it difficult for some residents to afford insurance.Effectiveness of TWIA’s Programs and Policies

TWIA’s programs and policies are designed to ensure its financial stability and its ability to provide affordable insurance to policyholders. However, there are ongoing discussions about the effectiveness of these programs and policies.

One area of concern is the potential for rate increases in the event of a major catastrophic event. TWIA’s rate structure is designed to ensure its solvency, but it can also lead to significant premium increases for policyholders, particularly in the aftermath of a major storm.

Another area of discussion is the availability of reinsurance for TWIA. Reinsurance provides TWIA with financial protection in the event of a major catastrophic event. However, the availability and cost of reinsurance can fluctuate, which can impact TWIA’s financial stability.TWIA in the Context of Texas Law

The Texas Windstorm Insurance Association (TWIA) operates within a complex legal framework established by the Texas Legislature. Its creation, operations, and policies are subject to various state laws, regulations, and judicial interpretations. Understanding the legal context surrounding TWIA is crucial for comprehending its role in providing windstorm insurance coverage to coastal residents of Texas.Legislative Framework

The Texas Legislature plays a pivotal role in shaping TWIA’s policies and operations. The association’s existence is rooted in the Texas Windstorm Insurance Act of 1971, which was enacted in response to the growing need for windstorm insurance coverage along the Texas coast. This act Artikels TWIA’s primary functions, including:

- Providing windstorm and hail insurance to property owners in designated coastal areas where private insurers are unwilling or unable to offer such coverage.

- Establishing rates and coverage terms for its policies.

- Managing its financial resources and ensuring its solvency.

The Texas Legislature regularly revisits and amends the Windstorm Insurance Act, reflecting evolving needs and concerns. For example, in recent years, the legislature has focused on:

- Addressing concerns about affordability and access to coverage.

- Strengthening TWIA’s financial stability and risk management capabilities.

- Improving the efficiency and transparency of its operations.

These legislative actions directly influence TWIA’s policies and operations, impacting the availability, affordability, and terms of windstorm insurance coverage for Texas coastal residents.

Impact of Court Decisions

Court decisions have also significantly shaped TWIA’s legal landscape. Numerous lawsuits have been filed against TWIA, challenging its policies, procedures, and coverage decisions. These cases have resulted in important judicial interpretations that have clarified TWIA’s legal obligations and the scope of its coverage.

- One notable case involved a dispute over the definition of “windstorm” and the coverage of damage caused by wind-driven rain. The court’s decision in this case established a precedent that clarified TWIA’s coverage obligations in such situations.

- Another significant case involved a challenge to TWIA’s rate-setting methodology. The court’s ruling in this case led to changes in TWIA’s rate-setting practices, aiming to ensure fairness and transparency in the determination of insurance premiums.

These legal precedents continue to guide TWIA’s operations and shape the legal landscape surrounding windstorm insurance in Texas.

Key Legal Issues

Several key legal issues continue to be debated and addressed in the context of TWIA and its insurance policies.

- The scope of TWIA’s coverage and its liability for specific types of damage remain subject to ongoing interpretation. For example, the extent to which TWIA is obligated to cover damage caused by wind-driven rain or other secondary perils is an area of ongoing debate.

- TWIA’s rate-setting practices are also subject to scrutiny, with concerns about affordability and the adequacy of premiums to cover potential losses. The balance between ensuring financial stability and affordability for policyholders remains a complex legal challenge.

- The legal framework governing TWIA’s relationship with private insurers and the role of reinsurance in managing risk continue to be debated and refined. The interplay between TWIA and the private insurance market is crucial to ensure adequate coverage for Texas coastal residents.

These legal issues continue to shape the legal landscape surrounding TWIA and its operations.

Ultimate Conclusion

As Texas continues to grapple with the increasing threat of hurricanes and the evolving landscape of climate change, the Texas Windstorm Insurance Association will remain a critical component of the state’s disaster preparedness strategy. By understanding the intricacies of TWIA, coastal residents can make informed decisions about their insurance needs and navigate the complex world of windstorm coverage with greater confidence. As the association evolves to meet the challenges of the future, its role in protecting Texas communities will undoubtedly remain paramount.

- Benefits: